Tapping into retirement accounts for business funding

I was reading my paper copy of Practical Accountant magazine the other day and noticed this small item in the Tax Briefing section.

ROBS Retirement Plans Targeted

An IRS memorandum has been issued containing audit guidelines for a version of a qualified plan being marketed as a means for prospective business owners to access accumulated tax-deferred retirement funds without paying applicable distribution taxes in order to cover new business start-up costs. The memorandum refers to these arrangements as ROBS (rollovers as business startups).

IRS indicates that they "may serve solely to enable one individual's exchange of tax-deferred assets for currently available funds, by using a qualified plan and its investment in employer stock as a medium. This may avoid distribution taxes otherwise assessable on this exchange. Although a variety of business activity has been examined, an attribute common to this design is the assignment of newly created enterprise stock into a qualified plan as consideration for these transferred funds, the valuation of which may be questionable."

This obviously has to do with the kind of plans that that I have discussed on numerous occasions, such as those offered by companies like BeneTrends. I haven’t seen any response to this yet from BeneTrends or any of the similar companies; but I’m hoping their plans will withstand any IRS scrutiny that may come their way because they are a huge help to small business owners, as well as a more productive investment vehicle for the retirement funds than the big stock market or other conventional vehicles.

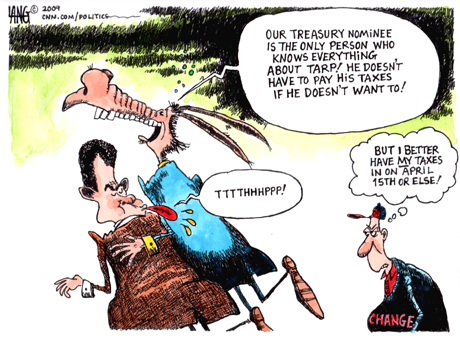

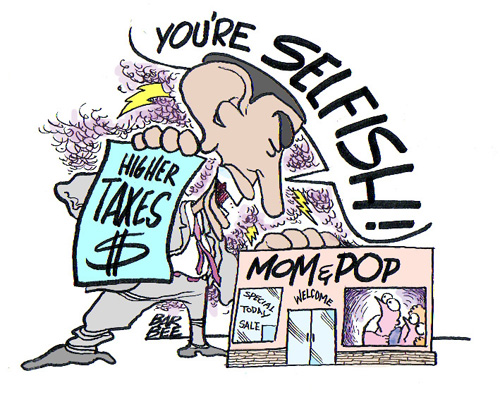

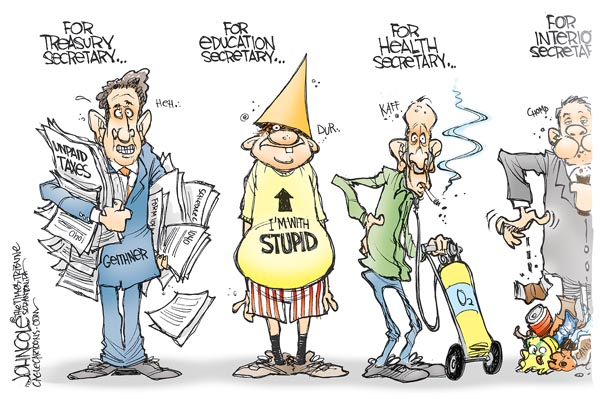

A Change in attitude we can Hope for...

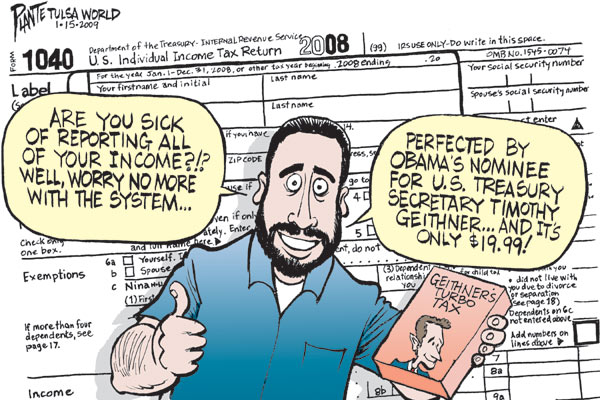

(Click on image for full size)

Labels: comix, Obambi, TaxCuts

New IRS Filing Addresses

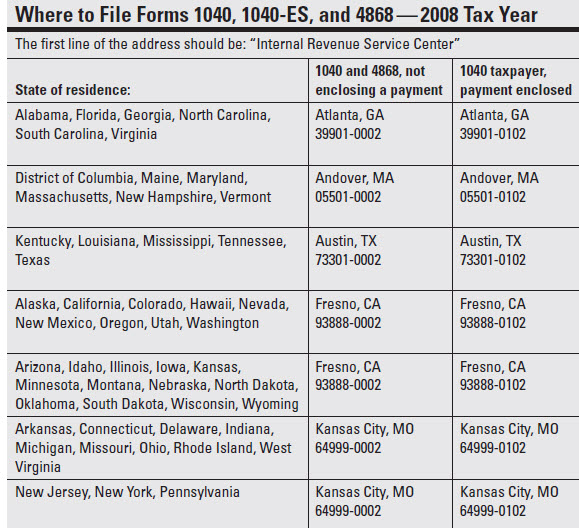

In their annual shuffling of service center workload, IRS has just announced that taxpayers in four states have to send their 1040s to different service centers than previously.

Delaware, New York and Rhode Island now mail to Kansas City

Illinois taxpayers send their 1040s to Fresno

I checked the filing addresses in the latest copy of TheTaxBook and they actually already had the new ones in there.

Labels: IRS

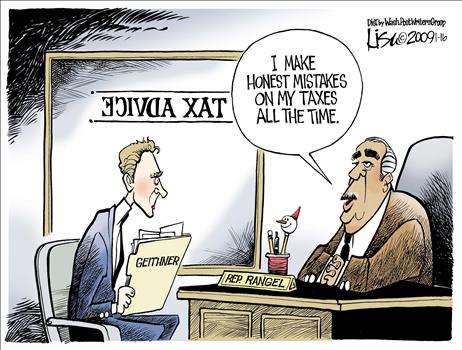

From Byron York at NRO:

More Questions About Geithner – Additional info, casting doubt on the “innocent mistake” defense that the media are providing for Geithner’s tax returns.

Due Diligence on Geithner – The National Review editors call for the GOP to vote against confirming Geithner. Based on the GOP’s current posture of rolling over for anything 0bambi wants, the chances of any real opposition are virtually nil.

From Accuracy In Media:

Why Are the Media Protecting Geithner?

Labels: Geithner

IOUs From the PRC

Anyone hoping to spend a California tax refund should give up on that plan, or at least be very patient. According to this news release from Spidell, they are so broke in Sacramento that they will be delaying paying out tax refunds for at least 30 days.

Of course, as always, this is a one way street. Any taxes owed to the PRC must be paid in immediately or you will be faced with serious consequences.

Labels: StateTaxes

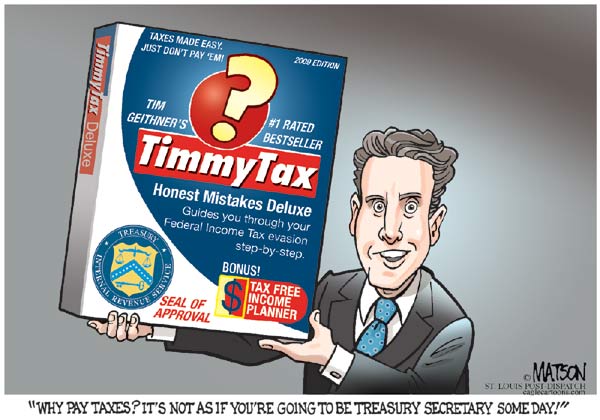

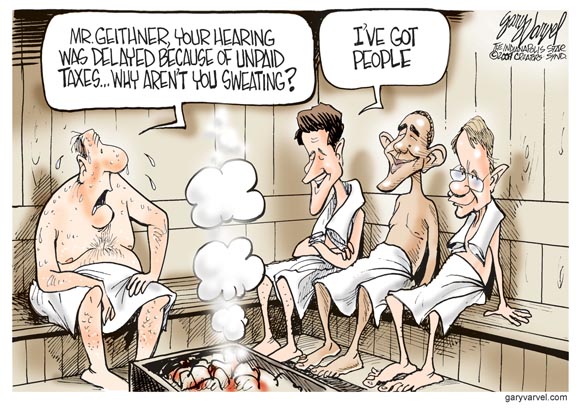

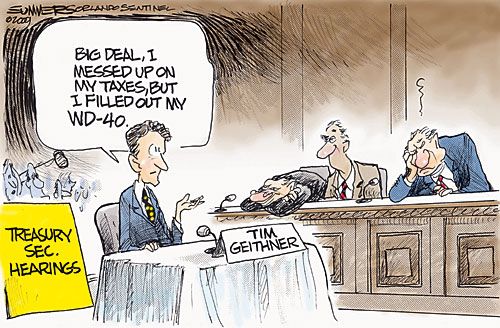

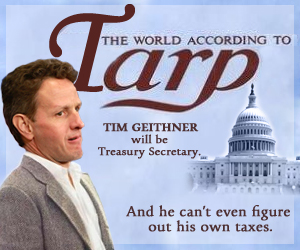

More jokes about the new Treasury Secretary

Anyone who follows politics knows that if this were a GOP nominee, he would have already pulled his name from consideration. Since he is with the party that has no ethical standards, and the media are doing their job of covering for him, he should have smooth sailing into power. In the meantime, he has replaced Wesley Snipes as the new face of idiotic tax moves.

From Scott Ott:

Bush Offers to Pre-Pardon Obama Treasury Pick

From Jay Leno via NewsMax:

At his confirmation hearing, Attorney General nominee Eric Holder said that as far as he is concerned, waterboarding is torture. And Treasury Secretary Tim Geithner said, “So is paying taxes.”

Geithner didn’t pay federal taxes from 2001 to 2004. He owed $34,000. But to keep his nomination afloat, he paid it this week — plus another $8,000 in interest. So that’s $42,000 the U.S. Treasury made — just like that. You know what Obama should do now? He should appoint Willie Nelson as commerce secretary. What does he owe, $28 million?

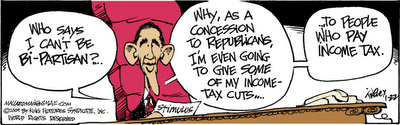

(Click on image for full size)

Labels: comix, Geithner, humor

From Jay Leno via NewsMax:

Obama says that he wants to bring a “sense of accountability” to Washington. I have a better idea — why not bring some accountants to Washington?

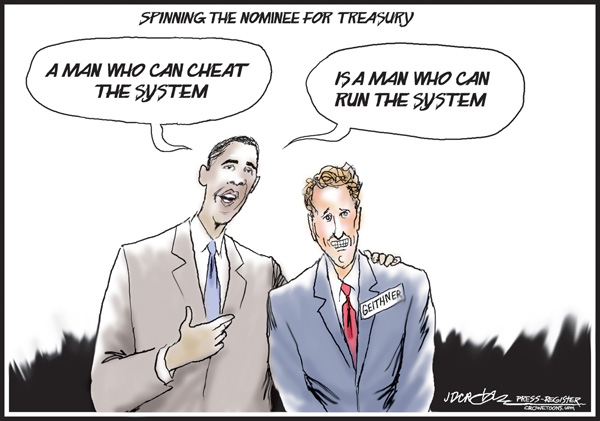

Speaking of that, Obama’s new secretary of the Treasury nominee, Timothy Geithner has come up with a new plan to lower taxes: Don’t pay them.

The IRS's new OverLord...

Geithner Accepted IMF Reimbursement for Taxes He Didn’t Pay - Byron York seriously explains the problem.

Scott Ott of Scrappleface explains how the incoming Treasury Secretary can solve all of the country’s economic problems, but can’t file a proper tax return.

Labels: comix, Geithner, Obambi

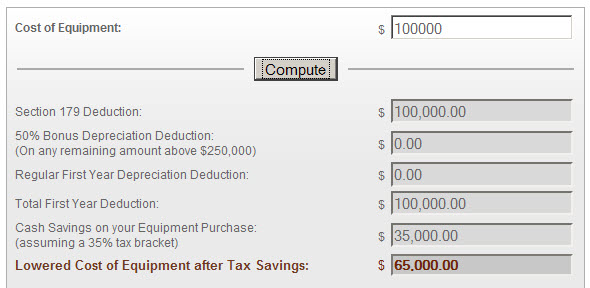

Calculating Sec. 179 Tax Savings

Q:

Subject: Section 179 Suggestion

Hello Kerry,

I came across your site here today trying to make heads or tails of my deductions for a store I just opened. I found your explanation to be quite clear and easy to understand over the IRS one. I didn't completely understand the cut off for vehicles. Thank you.

I also have a suggestion. I think it would be great if you added a calculator for section 179. I found a good one that helped me as well here. I think it might help others as well to get an estimate on what their deduction will be. I hope this was of help.

Have a nice day,

A:

I'm glad you found my info on Section 179 to be informative. It is meant to just be a starting point. Any actual calculations should be handled by your own professional tax advisor who can factor in the other criteria that will determine the actual expected tax savings. No online calculator can do a decent job of that kind of analysis.

For example, the one that you referred to is dangerously simplistic and incomplete in the information it works with and is really nothing more than a sales tool to make it appear that equipment costs less than it actually does. When I entered the figure of $100,000 in the Cost of Equipment box, it automatically assumed a tax savings of $35,000 for a net cost of $65,000. It didn't take into consideration some critical factors that could seriously limit the actual Section 179 deduction, such as how much other equipment was acquired during the year and the level of Taxable Income before any Sec. 179 deduction.

I don't mean to be harsh here, but one of the biggest mistakes I see constantly is people believing they can function in business without the assistance of an experienced professional tax advisor. While you may think this quick and easy calculator is helping you, it is almost certainly giving you the wrong information unless you are making huge profits and are in the 35% Federal tax bracket. Again, not to be cruel, but anyone making that kind of money is insane and financially irresponsible to try to navigate the tax waters on their own.

I'm sorry to dump on you here, but you pushed a button that needed expressing.

Good luck.

Kerry Kerstetter

Labels: 179

News Bits

California's Gold Rush Has Been Reversed – High taxes have consequences and are huge motivators for people to leave rather than just accept more fiscal rape.

Many states' lottery sales are rising in recession – Makes about as much economic sense as the government’s bail-out schemes.

We probably won’t have the tax free deaths in 2010 that are currently scheduled.

Estates of Pain

Fake IRS Emails – Snopes.com has an updated piece about the scam emails that are still going around pretending to be from IRS. It would really be great to see some news from IRS that they have been able to prosecute the scumbags behind these.

Labels: scams

Record keeping requirements - Good summary of rules from the California FTB that apply for IRS purposes as well. Calif. taxpayers need to be sure to catch the fact that the statute of limitations (SOL) for FTB to come after you is four years after filing a tax return, one year longer than IRS has. FTB is sneaky in exploiting that extra year. I have seen plenty of cases where people had tossed their records after the IRS’s three years SOL had expired, only to be unable to defend themselves against FTB assessments. With the current budgetary disasters in Sacramento, we can expect FTB to pull out all of the stops in regard to squeezing every last dime out of people, whether they really owe the money or not.

Labels: audits

News Tidbits:

Legality of proposed California tax plan in question – The rulers in Sacramento are trying to use sneaky tricks to get around the state’s two-thirds requirement for new taxes. Calling new charges “Fees” instead of “Taxes” is supposed to allow them immunity from the law.

Detroit lawyer gets 5-cent IRS bill, 4-cent refund – Classic case of the left hand not knowing what the right hand is up to.

A nicer IRS?

IRS Speeds Lien Relief for Homeowners Trying to Refinance, Sell – from IRS.

IRS Offering Leniency Plan For Taxpayers – from WSJ

Many Taxpayers Stand to Gain From New Laws – WSJ’s Tom Herman reviews some of the 2009 tax changes that are already on the books. As we all know, many more changes are in the offing based on what our new rulers in DC feel like doing in the next few months.

Confusing Tax Rules Under Fire – Has there ever been a more obvious headline? Again, as always when our rulers try to simplify the tax laws, there will be much more work for us sorting out their even more complicated mess. My infamous poster still fits the bill here.

Madoff Is a Piker – John Stossel with another comparison of Madoff’s Ponzi scheme and the much larger Ponzi scheme called Social Security.

Tyranny of the Tax-Exempt – Dick Morris notices that the proposed Obama “tax cuts” are really more welfare payments.

Are Tax Revolts a Thing of the Past? – With higher taxes being touted as the patriotic thing to accept, those of us who complain are going to be demonized even more.

State Tax Refunds

Reconciling the amounts to report as income on a 1040 with the 1099–G forms that State tax agencies send to IRS has frequently been a little tricky. When the 1099–Gs are showing incorrect information, I have learned that it’s impossible get the State tax agency to correct their mistake, so it is necessary to add explanatory info to the 1040 in order to avoid a document matching error down the road.

I just received this emailed press release from the Arkansas DFA admitting to some erroneous 1099–Gs that they sent to IRS.

Subject: FW: State 1099-G Form Issued with Incorrect Refund Amount

Please review the following press release:

The Department of Finance and Administration announced today that 28,040 taxpayers recently received 1099-G forms indicating an incorrect amount of refund or credit received by the taxpayer. The incorrect forms were mailed to taxpayers between December 22nd and 29th, 2008. The Form 1099-G is a Federal form that the Internal Revenue Service requires to be sent to taxpayers to remind them of the Arkansas Income Tax refund or credit they received during the previous tax year.

This problem occurred because of a computer processing error. When the 1099-G forms were produced, information from 2007 rather than 2008 was mistakenly used to create the forms. The 1099-G’s are currently being recreated using the correct 2008 information. The corrected 1099-G forms will be mailed to the affected taxpayers by January 9, 2009.We sincerely regret this error and any inconvenience you may have experienced as a result. We strive to provide quality service to the taxpayers of this state. When errors do occur, we will work to correct those errors as expeditiously as possible. If you have any questions or need additional information, please contact: Individual Income Tax at 501-682-1100 (Inside Pulaski County or Outside of Arkansas) or

1-800-882-9275 (Inside of Arkansas, outside of Pulaski County).Thanks,

As with most cases where an erroneous 1099 is followed up with a CORRECTED one, IRS ends up looking for both amounts on the 1040 rather than ignoring the first one. So, be careful when working on a 1040 for someone who was lucky enough to receive the admittedly incorrect 1099–G from DFA.

Labels: StateTaxes

Madoff Lessons

The best learning tool has long been OPM (Other People's Mistakes) because nobody can live long enough to make them on his/her own. The recent exposure of Bernie Madoff’s Ponzi scheme should be a good slap across the face to any investor.

From James B. Stewart of the WSJ – The Lessons to Be Learned From the Madoff Scandal.

From Jay Leno via NewsMax:

“Congress says they’re looking into the Bernie Madoff scandal. So the guy who made $50 billion disappear, is being investigated by the people who made $750 billion disappear.”

“His family says he suffers from multiple personality disorder. Apparently, every one of them is greedy.”

Labels: scams

Roth IRAs

I will soon be posting another email exchange with a reader on Roth IRAs. In the meantime, here are some recent items from the free WSJ on them.

Roth Is a Good Way to Hedge on Your Future Taxes

Labels: Retire

Improper property taxes?

Calls Grow to Cap Property Taxes – It’s been more than 30 years since the infamous Proposition 13 was passed in California in 1978 to try to hold the line on property tax hikes. It’s about time that more people in other states start fighting back against this immoral tax rather than just bending over and allowing their rulers to continue the fiscal raping of home owners.

While I despise pretty much all taxes, since they are really nothing more than methods for politicians to confiscate money from the public in order to spend on their own pet projects, property taxes are the least voluntary kind there is because you do absolutely nothing and are hit with them. Most taxes are generated by doing things, such as earning income, buying or selling things. Property taxes are new annual levies assessed on assets that you already own, and as many people unfortunately discover, the penalty for not paying them is the loss of the property itself. Older folks who happen to live in appreciating areas are forced to sell their homes because they can’t afford to pay the annual “rent“ on their own property. That is immoral and completely counter to the concept of private property ownership.

Labels: PropertyTax

Why We Keep Falling for Financial Scams - Interesting look at Ponzi and other types of scams that people fall for.

It should be noted, in the comparisons between Madoff’s Ponzi scheme and the Federal government’s Social Security Ponzi scheme, that “free market” scammers have to be more creative in order to lure in saps voluntarily. The Feds don’t have to convince anyone that Social Security is a good investment because they have the power to have the IRS stick guns in our faces and force us to pay into their financially insane scheme.

Labels: scams