Camel's nose under the tent...

WA State Senate proposal: Add income tax on wealthy to cut sales tax for everyone

Proving that the PRC isn't the only Left Coast state run by Marxist idiots, one of the few states without a personal income tax is so desperate for cash that they are proposing this soak the rich scheme.

Anyone with any knowledge of history, especially of the US Tax Code, knows where this will end up. It won't be long before an income tax only intended for the evil rich will be assessed on everyone.

Labels: StateTaxes

Refusing to bend over...

Montgomery sees huge decline in taxable income – It's always great to see when State rulers are slapped in the face with the real world fact that people in their cross-hairs for punitive taxation don't just bend over and accept it; but move to lower tax jurisdictions. States that think they can solve their fiscal blunders by sticking it even more to the “evil rich” will suffer the same consequences.

Labels: StateTaxes

More IOUs for TaxPayers

Cash-Strapped States Delay Tax Refunds; NY Says It's an Option - As always, crazy ideas hatched in the PRC have a way of spreading across the country.

Just try sending an IOU payable to your State in with your State tax return and count the days before your bank account is levied.

Labels: StateTaxes

The Highest Tax Increases Ever. State and local governments demand that their residents shut up and pay up during a recession. – An interesting look at some of the recent State tax hikes.

Labels: StateTaxes, TaxHikes

Tax refugees staging escape from New York – As always, any State rulers who didn’t see this as the inevitable result of increasing taxes are complete idiots.

Labels: StateTaxes

Killing the Golden Goose...

Risky business: States tax the rich at their peril - Too many of our rulers have short term mentalities and have no concern for the long range consequences of their decisions to steal as much money as they can from the "evil rich."

I am very happy to see that rather than just bend over and accept these kinds of financial rapes, more people are voting with their moving vans.

New Jersey, New York and California Have Worst Tax Climates for Business, Tax Foundation Says

Labels: StateTaxes

Florida Exodus: Rising Taxes Drive Out Residents - This is a bit ironic because so many people relocated to Florida specifically to escape income taxes in other states. However, as the shortsighted rulers of Florida fail to realize, it is the overall tax burden, including rapidly escalating property taxes, that motivate people to relocate to less expensive states.

Labels: StateTaxes

2009 California Tax Rates

Unlike the Federal tax rates, which have their annual inflation adjustments announced before the tax year starts, the geniuses in my former home state wait until the year is half over to do those calculations.

Spidell has just released a handy two-page pdf with the new 2009 inflation adjusted rates, credits and deductions for personal income taxes.

Labels: StateTaxes

More Unfair & Ridiculous State Taxes

Thanks to Neal Boortz for these bits on the efforts of many states to squeeze more money out of as many people as possible.

Facing budget gaps, U.S. states shuffle tax codes

Labels: StateTaxes

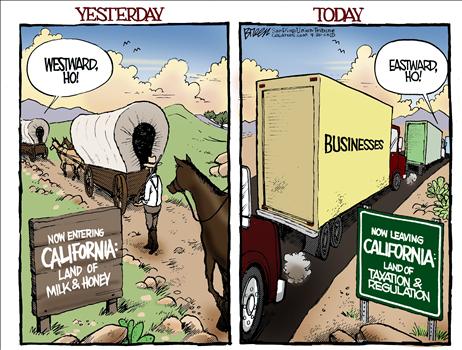

Californians react to the budget fiasco...

Exactly as we did almost 17 years ago.

Labels: comix, StateTaxes

Living with less...

While we in the private sector are expected to make do with less, our rulers in government are never expected to make any kinds of sacrifices.

Labels: comix, StateTaxes

States propose $24 billion in tax hikes – Minimizing state taxes is a game with constantly changing rules.

Labels: StateTaxes

Millionaires Go Missing – It’s always great to see when people reach their breaking point after being soaked with taxes and leave the high tax states, such as this article about Maryland. There will also be many similar stories about other high tax states whose rulers believe that they can fiscally rape high income folks with impunity, such as California and New York.

Labels: StateTaxes

Soak the Rich, Lose the Rich – Since using the ballot box is obviously ineffective at lowering taxes, the next best thing is to vote via moving vans and bail out of high tax states. It’s an excellent time for those of us who understand how to help clients source their income from low and zero tax states.

Labels: StateTaxes

Multi-State Taxes Are Not DIY

Q:

Subject: NY & MN

HI THERE GURU MAN,

I DON'T WANT TO BOTHER YOU, BUT YOU MAY HAVE AN IDEA OF WHOM I CAN ASK

(I TRIED TAXCUT/H&R BLOCK WITH MY SOFTWARE, BUT THEY SAID MY KEYCODE IS INELIGIBLE)I am doing taxes for a friend who is a full-time resident of Minnesota, but has a New York w-2.

She has $1498 of NY state taxes withheld.

I listed her as a non-resident of NY and full-time resident of Minnesota in the personal information in the software.

Now how do I go about preparing the state taxes? Do I need to buy and download New York software?

Then what will I do next (so that it does not just show that she owes $1184 to Minnesota?)I DON'T KNOW WHO ELSE TO ASK???

HOW IS TAX SEASON GOING FOR YOU?

A:

Multi-state tax returns are very tricky and most professional level tax programs have a hard time doing it properly. It wasn't until just a few years ago that the Lacerte software, which I use, was improved enough to do the multi-state returns almost automatically. Even so, I still often have to do some manual tweaking to get everything right.

The consumer DIY programs are not designed for anything that complicated and odds are that errors will slip through, resulting in a lot of hassles with both state tax agencies.

My point is that this is case for a professional tax preparer who is experienced with multi-state tax returns and not a task that you should be trying to handle on your own.

Good luck.

Kerry Kerstetter

Follow-up:

Aren't you just the sweetest man alive!!!

Thank you for writing back to me.

When taxes are finished, we ride our bikes!

thanks again.

Labels: StateTaxes

Dangerous trend with state tax agencies...

Kansas suspends income tax refunds – It’s not just the PRC pulling this scheme.

Labels: StateTaxes

IOUs From the PRC

Anyone hoping to spend a California tax refund should give up on that plan, or at least be very patient. According to this news release from Spidell, they are so broke in Sacramento that they will be delaying paying out tax refunds for at least 30 days.

Of course, as always, this is a one way street. Any taxes owed to the PRC must be paid in immediately or you will be faced with serious consequences.

Labels: StateTaxes

State Tax Refunds

Reconciling the amounts to report as income on a 1040 with the 1099–G forms that State tax agencies send to IRS has frequently been a little tricky. When the 1099–Gs are showing incorrect information, I have learned that it’s impossible get the State tax agency to correct their mistake, so it is necessary to add explanatory info to the 1040 in order to avoid a document matching error down the road.

I just received this emailed press release from the Arkansas DFA admitting to some erroneous 1099–Gs that they sent to IRS.

Subject: FW: State 1099-G Form Issued with Incorrect Refund Amount

Please review the following press release:

The Department of Finance and Administration announced today that 28,040 taxpayers recently received 1099-G forms indicating an incorrect amount of refund or credit received by the taxpayer. The incorrect forms were mailed to taxpayers between December 22nd and 29th, 2008. The Form 1099-G is a Federal form that the Internal Revenue Service requires to be sent to taxpayers to remind them of the Arkansas Income Tax refund or credit they received during the previous tax year.

This problem occurred because of a computer processing error. When the 1099-G forms were produced, information from 2007 rather than 2008 was mistakenly used to create the forms. The 1099-G’s are currently being recreated using the correct 2008 information. The corrected 1099-G forms will be mailed to the affected taxpayers by January 9, 2009.We sincerely regret this error and any inconvenience you may have experienced as a result. We strive to provide quality service to the taxpayers of this state. When errors do occur, we will work to correct those errors as expeditiously as possible. If you have any questions or need additional information, please contact: Individual Income Tax at 501-682-1100 (Inside Pulaski County or Outside of Arkansas) or

1-800-882-9275 (Inside of Arkansas, outside of Pulaski County).Thanks,

As with most cases where an erroneous 1099 is followed up with a CORRECTED one, IRS ends up looking for both amounts on the 1040 rather than ignoring the first one. So, be careful when working on a 1040 for someone who was lucky enough to receive the admittedly incorrect 1099–G from DFA.

Labels: StateTaxes

States set to impose bevy of new taxes - and the State rulers will be shocked when more and more people take steps to avoid paying all of the new taxes, including physically leaving the high tax states.

Labels: StateTaxes

A RINO wants to tax pets in the PRC...

A Recommended Sales and Use Tax Proposed by Governor Schwarzenegger Will Tax Veterinary Services - People are already calling this a “Pet Tax,” courtesy of the RINO governor of the PRC.

It's an understatement to say that those of us expecting some change in the big government mentality in Sacramento are sorely disappointed in the administration of Ted Kennedy's nephew in law. Rush Limbaugh put it quite well in today's show.

"Can you understand how Gray Davis is probably laughing himself silly? He was thrown out of office for stuff that made far more sense than this. I just say, wait 'til Bloomberg hears about this, the esteemed mayor of New York City."

There is already a movement to fight this new proposal, claiming that pets are not furniture, and shouldn’t be taxed as if they were.

Labels: StateTaxes

2008 California Tax Rates and Exemptions - FTB has just released their inflation adjusted tax brackets and other affected figures.

Labels: StateTaxes

MySpace boast nets partiers $320K Okla. tax bill - Interesting tactic by the OK Tax Commission, trolling for possible tax cheats bragging on the internet. Remember that Big Brother is watching everything you say and checking that you paid all of the taxes on all of the income you claim to have made.

Labels: StateTaxes

How Not to Balance a Budget - The WSJ looks at how higher state taxes motivate more people to leave those states. This is common sense to almost everyone except the rulers in Sacramento and Albany. They continue to believe that people will just stick around and subject themselves to more and more financial rape.

Labels: StateTaxes

Interesting Tax Stats

Summary of Latest Federal Individual Income Tax Data – via the Tax Foundation

Tell the Legislators: Low Taxes and Regulations Are Good for Growth – Reviewing the ALEC’s State Economic Competitiveness Index. You can download the full 114 page report here.

Labels: StateTaxes, TaxBurden

California as No. 1 – This mindset of the rulers in the PRC, to tax the heck out of everything and everybody, was one of the contributing factors to my decision to leave that state 16 years ago. With a RINO as governor, there is no stopping the tax hiking mania that can only get worse.

From a professional perspective, this will be great for our business; those of us who understand the techniques for helping clients legally avoid having to pay Calif. taxes.

Labels: StateTaxes

Ozarks Disaster Relief Delay

We have been having a ton of rain and nasty weather in this part of the Ozarks for the past several weeks. I received this from a client with whom I have been working on establishing payment amounts for their extensions:

Kerry, I thought our county got an auto extension because of the flooding until late may. If not, I can come up with 52k like i did last year without a lot of pain.

I checked both the IRS and DFA websites and found this notice on the DFA site:

April 11, 2008

Tax Relief for Disaster Victims

LITTLE ROCK, AR— The Department of Finance and Administration announced today that taxpayers in 52 counties declared state disaster areas due to damages caused by severe storms, tornadoes, and flooding will be provided special tax relief. The Department is extending the deadline for taxpayers who reside or have a business in the disaster areas to file and pay any tax due on their individual or corporate income tax returns until August 15, 2008.

Affected Counties The affected counties are: Arkansas, Baxter, Benton, Boone, Carroll, Clark, Clay, Cleburne, Conway, Crawford, Craighead, Cross, Faulkner, Fulton, Garland, Greene, Hot Springs, Howard, Independence, Izard, Jackson, Jefferson, Johnson, Lawrence, Lee, Logan, Lonoke, Madison, Marion, Mississippi, Monroe, Nevada, Newton, Perry, Phillips, Pike, Pope, Prairie, Pulaski, Randolph, St. Francis, Saline, Scott, Searcy, Sharp, Stone, Van Buren, Washington, White, Woodruff, and Yell.

In addition the Department will waive the failure to file, failure to pay, and interest charges for businesses unable to make withholding deposits for tax payments due April 3, 2008 to May 27, 2008 because of the recent storms, tornadoes, and flooding.

When claiming the special extension on a 2007 State income tax return payment document, please write Disaster Storms” on the front of the mailing envelope and on the top left corner of the income tax form. This helps speed-up processing of your return. If you receive a notice of penalties and interest, call (501) 682-1100 to request relief.

My reply to the client:

The floods were only a state level disaster, not Federal. DFA has put out announcement that they are giving people in the flood counties until 8/15/08 to file their Arkansas tax returns. This does not apply to IRS. I just checked the IRS news site and there is no mention of any special extensions.

My experience with DFA is that they are terrible about actually following through with this kind of special deal. The relief notice even says that anyone receiving penalty notices will have to call a special phone number in order to get them dropped.

If you have the money, it would be safest to just pay both the IRS and DFA amounts by Tuesday.

Kerry

Additional Info:

Because these severe weather problems also affected the Missouri part of the Ozarks, I wondered if that state had a similar extension of the tax deadline. I just checked on the MDOR’s website and they have given people in the affected counties until May 19, 2008 to file their 2007 tax returns..

Labels: StateTaxes

Out of state corp

Q:

Hi Kerry,

I read your internet article about c and s corporations and have a quick, rather silly question. We live in CA, but have property outside of the state and want to put the property under a corporation. Is there any legal method of forming a corporation outside of CA when we live here?

Thanks,

A:

Anyone can establish a corp in any state. You will however have to have someone located physically inside that state to act as the registered agent to be able to receive paperwork on behalf of the corp. This can be a friend or relative or one of the many professional services that do this for a fee. Some people use a mail forwarding service. You should check that particular states rules in regard to what will satisfy its requirements.

The issue of how the corp will be taxed and the relationship to your personal CA taxes has far too many variations and is something that you need to discuss with your own professional tax advisor.

Good luck.

Kerry Kerstetter

Follow-Up:

Hi Kerry,

Thank you so much for the great information!

Labels: corp, StateTaxes

Working in multiple states

Q-1:

Subject: Tax question and Help

HI:

I found your website after spending several hours researching my situation and looking for answers.

I am hoping you could point me in the right direction or give me suggestions of what my options are.

My husband and I currently provide safety programs to businesses. We operate in three states – Washington, Oregon and California. In 2008 right now we will make at least 500K if not $100-200K more. The income breaks down as follows per state. Washington - $250K, California - $200K and Oregon - $50K.

We are currently incorporated as an s-corp in Oregon. For the last three years we have had a large NOL from a previous business (sole prop) that we carried over, so we never really felt the potential high taxes from Oregon. We tried our best to expense out all the other income from the other states, except Washington which has a gross B&O tax that was not that bad, but they don’t have personal income tax.

But this year we are faced with a whole new ball game. I have roughly figured out that our expenses will be about 30% of our gross profits. Our business has no debt and our biggest expense is travel expenses as we go to clients to consult with them at their facilities. We have a lot of personal debt, so leaving the money in the corporation is not an option if we go the route of a C. But from what I can tell if we pull it out the wrong way, we then get hit with higher taxes. Our biggest personal deduction is our mortgage interest of 60K and we have three kids. To live personally we need approx $12,000 net each month.

We have gotten legal and accounting advice and all of the solutions seem to be way too much of a headache and the amount of work I am going to have to maintain a legal paper trail also seems overwhelming. We have been given suggestions of multiple LLC’s for each state, management corporations (c-corps), tax shelters, etc...... Go to Nevada, Wyoming, stay in your home state............ HELP!!!!

To be honest we are the classic co-minglers, don’t keep good paperwork or annual corp meetings and have been lucky that we have not been audited. My biggest is fear is that once we get everything reorganized that I will miss filings, will mess up on the dates, basically just not know all the in’s and out’s so i get into trouble and pay the price. I need to get my house in order, but want to find the simplest way to do that and pay less tax from the feds to the states.

A-1:

I'm not sure what you're expecting from me. If you're going to be working in multiple states and making that much money, there is no way to have a simple hassle-free life when it comes to taxes. Tax complication comes with the territory.

When I was located in California, I had some clients who had businesses in all three left coast states; so I know what can be done to save huge amounts of state taxes by shifting as much of the profits into Washington as possible.

You have similar opportunities to shuffle income around and save on your taxes. What you will most likely need to do, besides working with a professional tax advisor who is experienced in multi-state businesses, is to have your own full or part time bookkeeper who can keep the QuickBooks files for each company as up to date as possible. This is the only way you will be able to do a decent job of dealing with the tax issues that are unavoidable. Trying to handle all of the bookkeeping tasks on your own, while conducting your actual business, is putting too much stress on you. Since QuickBooks is the most widely used and easiest to learn accounting program in the country, you should hire someone with QB experience and synch up with a professional tax advisor who also works with QB.

Good luck.

Kerry Kerstetter

Q-2:

Thanks for responding,I have spent a great deal of time reading information online, books, etc...And know there has to be a better way of doing business than we are structurally.I currently use QuickBooks for my one co-mingled account, etc.... I agree with you that hiring a bookkeeper to keep track of everything is the way to go.We have very low expenses compared to most businesses. I probably write 10 checks or less a month for those expenses in all states of doing business. I have an online payroll service for the 2 employees that we do have in those other states.Having said all of this::::I have been to several tax attorney's, CPA's, etc... Who seem to have answers wide and far from each other on what to do. I have yet to find one who has given me a plan that will decrease my taxes in each state as well as tell me how to set things up and give me instructions so I can hire a bookkeeper to do the steps to keep my paper trail going.Do you know of anybody on the west coast that can help me with a plan of attack and tell me what structures to put in place in what state as well as tell me how we need to run the finances for each of those states and what expenses I should run in what state back and forth, etc . I need detailed guidelines of how to move the money and expense it out legally.Thanks

A-2:

Unfortunately, we don't have anyone specific to whom we could refer you. I did recently post some names and links for some like-minded tax pros around the country.

If you haven't already done so, you should check out my tips on how to select the right tax preparer for you.

You should note that geographic location should not be the main criterion for selecting a tax pro.

I wish I could be of more assistance; and I wish you the best of luck.

Kerry Kerstetter

Follow-Up:

Thanks I will take a look at your list and go from there.

Labels: StateTaxes

Winning the lottery?

State mistakenly sends man check for $2,245,342 – A bit more than the $15 he was expecting. This man did the right thing and sent the check back. The Utah officials claim they would have eventually noticed the mistake if he had cashed it and would then ask for the money back. However, with that much dough, who knows where he would actually be by that time?

Labels: StateTaxes

Florida as tax home...

People of all income levels have moved from high tax states to tax free states, such as Florida and Nevada. Often, they're shocked to see that their overall tax burden is still more than they would like due to much higher sales and property tax rates in those states with no income tax.

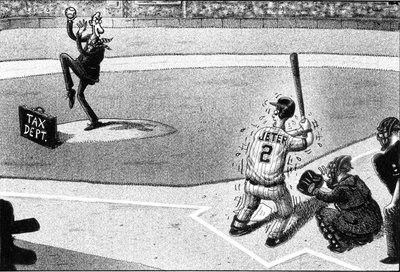

As I constantly warn people when planning such a strategy, income from services rendered and property owned inside states with income taxes will still require paying those states their share. This applies to everyone, but is more dramatic with the big money earners, such as professional entertainers and athletes. Rush Limbaugh always mentions how much he has to pay in New York taxes when he broadcasts from his studio there instead of from his main home base in Florida.

There is currently a high profile case with baseball player Derek Jeter that is getting some press.

(Click on image for full size)

Labels: comix, StateTaxes

Nevada LLC...

Q:

Kerry,

Hello I hope all is going well. I recently viewed your website and was inspired to contact you based on the fact that you seem to have a no b.s. attitude towards taxes. I have an LLC which buys and sells real estate and I am in the process of selecting my CPA. The physical address is in Va, but I Incorporated in NV and would like to find someone who can help me maximize my profits through taxes. Any chance you would be able to help me or have an recommendations?

Best Regards,

A:

There are far too many options to consider and possible scenarios that can be used to achieve your goals for me to even begin giving you specific advice via this medium. You will need to work directly with an experienced tax pro who can analyze your unique circumstances.

You need to be extra careful of the state tax issues. Just having your corp set up in Nevada won't negate the requirement to file tax returns for any other states in which you sell real estate. However, a good tax advisor will be able to help you devise effective ways by which to shift the net profits out of the taxable states to the tax free Nevada. In fact, that would be a good question to pose to any prospective tax advisors you are considering using. Any who don't know how to do this, or tell you it isn't possible or is too much hassle to justify the tax savings, are obviously not experienced enough to fill your current needs.

I wish I could be more help; but I already have too many clients to take care of properly; so we are still trimming back on the difficult clients and are not accepting any new ones at this time.

Unfortunately, we don't have anyone specific to whom we could refer you. I did recently post some names and links for some like-minded tax pros around the country.

If you haven't already done so, you should check out my tips on how to select the right tax preparer for you.

I wish I could be of more assistance; and I wish you the best of luck.

Kerry Kerstetter

Labels: LLC, StateTaxes

Tax Board Outs Simpson, Sinbad, Warwick – The entertainment press has picked up on my earlier piece on the Calif. FTB’s list of unpaid taxes by celebrities. I didn’t recognize Sinbad’s name on my first review of the list; but now we know who that is and that he owes over $2.1 million to the FTB.

Labels: StateTaxes

People will move due to taxes, a fact that short-sighted state rulers refuse to acknowledge.

Labels: comix, StateTaxes

Publicly shaming delinquent taxpayers

The California Franchise Tax Board has a policy of posting the names of taxpayers (or more accurately, non-payers) who owe more than $100,000 on this special page on their website. They show the amounts and the city where the taxpayer was last known to reside.

As I’ve always mentioned, merely crossing the borders of the PRC is no reason to feel secure from the FTB’s extremely aggressive collection actions. Several of the names have non-California addresses, including some celebrities such as:

Orenthal Simpson of Miami, FL owing $1,435,484.17 for personal income taxes

Dionne Warwick of S. Orange, NJ owing $2,665,305.83 for personal income taxes

What tax collector is crazy enough to go after OJ Simpson for back taxes, knowing his method of dealing with exes (ex-wife, ex home state)?

Labels: StateTaxes

State Section 179 Rules

Q:

Subject: Listing of States conformity to Section 179I was just viewing your website and was wondering if you had an updated list of each state and it's conformity/non-conformity to Section 179?

A:

I'm not aware of any such list. That sounds like an interesting project for one of the tax reference publishers.

In the meantime, we have to continue researching this on a state by state basis.

Thanks for writing.

Kerry

Labels: 179, StateTaxes

State tax home is critical...

Q:

Subject: State tax question

Hello KMK,

Tax Guru is a neat website. Compliments!I am an Illinois accountant with a client with an Illinois S-corporation, but who lives in California. With the lower Illinois individual income tax rate, I would like to have Illinois tax the S-corporation income, and leave it off of the California individual return. Do you know how to do this in the California return?If you do "out-sourced" tax research for others, please let's discuss your charges for the service. Thoughtful research is appreciated.

A:

It will all depend on which state is your client's official tax home. If it's California, he will have to report all income from all sources (including the IL 1120S) on his Calif. 540. Of course, he will also need to file a nonresident IL return. He will be able to claim a credit against his CA taxes for part or all of the IL tax on that income. As you know, the net effect of the out of state tax credit is that he ends up paying the higher of the two states' taxes.

If your client can establish his official tax home in IL or another state, he can file a 540-NR as a CA part year or nonresident and then only allocate his CA source income to that state. Many people use tax free states, such as Washington, Nevada, Texas, or Florida, as their official tax home for just this reason.

I hope this helps. I'm still not caught up enough with the workload with my current paying clients to be able to accept any new ones. General questions that should be of interest to my blog readers are always welcome however.

Good luck.

Kerry Kerstetter

Follow-Up:

Thank you for your prompt reply, and good advice.

Labels: StateTaxes

2007 California Tax Rate Schedules

Unlike with the annual inflation adjustment for the Federal individual income tax brackets, which are released well before the next year, the California Franchise Tax Board doesn’t release its new brackets until well into the subject year. They have just now released the 2007 rate schedules.

Based on previous years, the 2008 Federal tax schedules should be out in about three weeks and will be posted on my main website shortly thereafter.

Labels: StateTaxes

Illinois Tax Picture

Illinois House overwhelmingly rejects business tax proposal

Labels: comix, StateTaxes

State Tax Shifting

Shifting income from high tax states to those with low or zero tax rates has long been part of any aggressive tax saving strategy. I've been helping clients exploit these differences for decades.

I am amazed at how many people still live in a fairy tale world and deny that taxes at all levels (local, State, Federal) are very powerful motivators for behavior and thus think they can arbitrarily raise taxes with no consequences in the form of taxpayers leaving their jurisdiction.

There is a good explanation of how this works in real life in today's National Review Online. Purely by coincidence, the town discussed is half located here in Arkansas.

Labels: StateTaxes