Tax Guru-Ker$tetter Letter

Saturday, November 30, 2002

Taxpayer Dollars To Communists

Many people think that Rush Limbaugh is exaggerating when he claims that the environmental wacko groups are the new havens for Communists. However, Rush is absolutely correct in that assessment. One of the planks of the Communist Manifesto is a ban on private ownership of property. Such private ownership of property is one of the fundamental requirements for a free capitalist society, which is what the USA was intended to be by our founding fathers.

I have long studied many of the big environmental groups, such as GreenPeace, Sierra Club, Nature Conservancy, John Muir Society, and Earth First (a terrorist organization) and read a lot of their materials over my lifetime. As the owner of some large properties, I was always struck by the goals (both stated and implied) of these organizations. Most of them are outright anti-human and anti-technology, in the same vein as Al Gore and his protege, Ted Kaczynski (the UnaBomber). They want to reduce the population of humans. They want to only allow people to live in small specified areas, so that wildlife can live undisturbed on the bulk of the planet. They also want no private ownership of property. It should all be controlled by government, ideally the United Nations.

It's bad enough that many people who donate to these groups don't understand their true agenda and just think they want to keep hiking trails clean. It's even worse when our own government uses money taken from people who don't support communism and give it to these very same groups who literally want to destroy our rights to own and use our own property.

KMK

Stupidity On Trial

One way the idiots who fall for the tax protestor scams think they can cover their butts is by getting an official opinion from a tax attorney or CPA that they are not subject to income taxes. Supposedly, by relying on the opinion of a tax professional, it absolves the individual for any personal responsibility for the non-filing and other related penalties. There are a number of attorneys, CPAs and other unlicensed so-called "Tax Professionals" who make a good living selling such opinions to gullible saps. Those opinion letters are worthless in a court proceeding and come with a no refund policy.

KMK

Missing the PRC - Not!

Higher taxes and fees? Fewer services? It sounds an awfully lot like the Post Office's strategy for success out there on the Left Coast. It's not that things are that much different here in the Ozarks; but they are nowhere close to the huge scale of problems with the PRC.

KMK

Friday, November 29, 2002

Thursday, November 28, 2002

Big Brother

With all of the talk about the new level of government snooping and data accumulation on everyone, it's a good time to remind you that this is nothing new for the Federal government. IRS has long been maintaining top secret files on every person and business in the country. They are called Individual Master Files (IMF) and Business Master Files (BMF) respectively.

Just as with credit records, these files often contain erroneous information that can lead to serious problems. Since our rulers have always considered tax revenues more important than anything else, IRS has always been allowed to ignore the normal constitutional protections that are available for every other aspect of life in this country. It is no exaggeration to say that the two snipers who were murdering people in the DC area have more rights and protections before they are sent to prison or executed than do people in matters with IRS. There is no presumption of innocence in tax matters and IRS is allowed to do its worst to people without any due process.

That's why it's not a bad idea to file a Freedom of Information request to obtain a copy of your file. There are some other sites on the web that have the forms and instructions for doing this, and will file the requests and decode the reports, for a fee.

IMF Help

IRS Decoder

KMK

Too Many Tax Reform Ideas

Here are a number of recent discussions on how to reform the tax system in the USA. While at first blush it is good to see so many people acknowledging the need for some substantial change, we've been down this road before, several times. When so many different options for change are proposed, the public's brain locks up and we almost always end up with no change. Analysis paralysis.

It's exactly like what good sales people are taught when working with customers. Show them just a few selections from which to choose. If you show them too many at one time, their brain starts to smoke and they will back away and refuse to make any decision. That is what always happens any time there are several different tax change ideas bandied about. People say that it's just too confusing and they would rather just leave everything as is. The devil you know vs the devil you don't know cliche; which is very apropos for taxes.

However, just to stay on top of what ideas are being discussed, I have some current examples to look at.

Replacing the income tax with a national sales tax is an idea I have long supported; but it's too radical a change to expect to actually happen. The only way to make it effective would be to partner this change with an official repeal of the 16th Amendment. Otherwise, the income tax will be resurrected in a few years.

Here is a perfect example of an unpleasant reform. This Yale professor wants to remove the income tax for everyone except the evil rich (anyone earning more than $100,000 per year) and then jack up income and estate taxes on the evil ones. He wants to also add a national sales tax for everyone.

Tinkering with certain details of the current tax system is what generally makes it into reality.

Whichever kind of tax system we have, from now until the end of time, there will be a need for those of us who can advise clients on how to minimize their taxes. Even with inexpensive tax computer programs and free electronic filing, it is still a matter of GIGO (garbage in, garbage out).

KMK

Wednesday, November 27, 2002

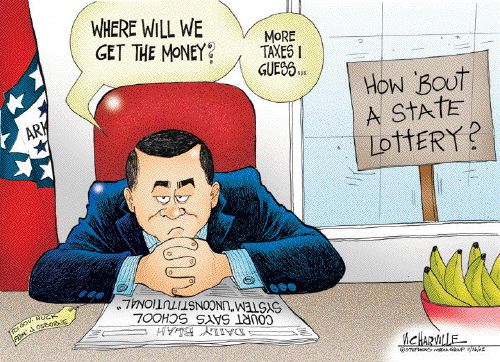

Grasshopper States

The story of the grasshopper and the ant is an excellent illustration of why so many states are having budget deficits. Spending like a drunk sailor while revenues were up, and pretending that there would never be a down cycle, was nothing less than sheer incompetence by the State Rulers.

KMK

Electronic IRS Payments

As I have explained on several occasions, I am not an advocate of electronic filing of Federal or State income tax returns because the format still does not allow us to add the additional documentation necessary to avoid audits. However, I am interested in learning about the IRS's system for receiving tax payments electronically. IRS just issued a press release touting its success, piquing my interest.

One of the most frustrating matters in dealing with IRS is the application of tax payments. I always advise clients to write their SSNs and the tax year on the face of their checks to try to ensure that IRS posts it to the correct year. Even when a check is being sent in to IRS along with a payment coupon or voucher, you need to assume that the check will go in one direction and the voucher in another. The check itself has to tell the complete story as to where it should be applied. Even with this information written on the front of checks, there are at least a dozen clients each year who have their payments posted incorrectly by IRS, normally to a different year than what was intended. This results in nasty-grams from IRS for the supposedly unpaid tax. While common sense would motivate most people to automatically look into other years for an equal overpayment, IRS has never been known to have any such intuition. It normally requires a lot of time working with IRS to track down missing payments.

What is critical in this kind of investigation is the back of the cancelled checks. IRS imprints some very tiny numbers on the back that usually identify where the check was applied. Without those checks, it's a guessing game. That is why it is important to use a bank that returns your actual checks rather than send you a photo-copy of the check's front, as more and more banks are doing.

I am researching this service myself. I have gone to their website and will sign up both as an individual and for one of our corporations. I am also very interested in hearing from anyone who has been actually making payments through this means, especially for an older year, where most misapplications happen. I will report on my findings.

KMK

Crediting Kids

I have long advised people on many of the ways to use kids to save on taxes. Shifting income from high tax bracket parents to low or zero tax bracket kids has long been a way to dramatically reduce the income tax burden. Now, it seems a lot of parents have been shifting their credit problems to their kids.

When people have credit problems, it has long been possible to get a semi-fresh start by filing Form SS-4 with IRS and obtaining a Federal Employer Identification Number (FEIN) that can be used in place of a person's Social Security Number (SSN). While credit repair services charge for doing this, anyone can do it for free.

Another way some people have been using to obtain credit, in spite of bad personal histories, has been to apply for credit cards under their kids' names and SSNs, often not telling their kids they are doing this. Very sneaky. However, as this story describes, when the parents don't pay off their kids' accounts, it leaves a very nasty trail that ends up hurting the kids when they try to obtain credit on their own.

I have to admit that I wasn't aware of how large this problem had become, mainly because I can still recall that credit cards weren't issued to kids when I was growing up. I didn't get my first credit card until I was almost out of college, and it was a special Bank of America program for college students at the time. Its limit of $300 wasn't as dangerous as the cards that are currently being issued to young folks.

KMK

Tuesday, November 26, 2002

Unclear On the Concept

Proving yet again that membership in Mensa is not a requirement to be elected to public office is Arkansas Representative Don House. He wonders why truckers would prefer to license their vehicles in Oklahoma for $51 instead of in Arkansas for $6,380. What a mystery. We should convene a special session of the legislature to figure that one out. Oh, that's right. That's what they did in Little Rock.

This is a perfect illustration of why I never worry about having a career. Whenever the issue of replacing the income tax with a sales tax comes up, people very sincerely wonder what I will do to make a living. Money is money. People will still use creative accountants to help them save thousands of dollars in sales taxes, just as they do for income and estate taxes.

KMK

Taxing The Web

Here's another look at the attempt by States to tax sales over the Internet. Obviously, with their fiscal problems, they are now much more motivated to implement something like this "simplified" system than they were a few years ago, when capital gains taxes were rolling in and they had plenty of money.

KMK

Higher State Taxes On The Way

This isn't news; but another warning that most of the states will be looking for all kinds of ways to increase their tax revenues. Depending on which types of taxes are increased where you live (income, property, sales, etc), it might be a good time to re-evaluate where you want to make your tax home.

KMK

Monday, November 25, 2002

Tax Cuts Don't Cause Deficits

I have expounded ad nauseam on how the liberals persist in mis-characterizing actual historical events by blaming the huge federal budget deficits of the 1980s and 1990s on the Reagan tax rate cuts. Some are even so blatant as to blame the current deficit on the tiny little rebate checks that were sent out. As the debate over making the tax rate cuts permanent, and hopefully even accelerating them, becomes more serious, we will be exposed to more of these lies. These two articles, by Larry Kudlow and by Victor Canto, are good at explaining that deficits are more a function of the overall economy than tax rate cuts.

It's always been a puzzler that liberals are always so opposed to tax rate cuts, when they actually result in much more money for the Imperial Federal Government, which they can then spend as their hearts desire. While I haven't heard any liberal actually address this inconsistency (mainly because they persist in pretending that tax rate cuts don't result in more revenue), my theory is one of power. If they can snatch 70% of everyone's paycheck, they have much more power over the lives of us commoners than if they were only able to grab 28%. The fact that people will work less hard as a result is simply immaterial to the mind of a power-mad liberal. It really isn't much different than classic communism, where all money and wealth belong to the central government and the elite rulers decide how much to allow the little people to have.

KMK

Gambling With The Home

It sounds too stupid to be true; but I'm failing to find the ironic wink to indicate that this is a joke. Who in their right mind would advise people pulling out all of their home equity to invest in the stock market? Why not take the money and go on a gambling spree to Las Vegas or Atlantic City? At least they would get some free drinks and cheap buffets; amenities most stockbrokers don't offer as their clients lose their money.

Considering the fact that, for most people, their homes represent the major portion of their net worth, and an essential resource for their retirement years, gambling it all on stocks is insanity.

KMK

Talk in Capital of Easing Taxes on Dividends

Eliminating the double taxation on corporate dividends is long over-due; but let's not count on this getting through Congress just yet. The perception is still rampant that only evil rich people receive dividends and the media make sure we never forget that tax breaks for the evil rich are themselves more sin-ful than just about anything imaginable.

KMK

Sunday, November 24, 2002

Tax Re-Form

As I've said before, the term "reform" doesn't always mean an improvement. As sincere as our rulers in DC may be about wanting to simplify the tax system in this country, their results won't be any better than after the last 30 or 40 tries.

Besides the fact that there is no consensus as to what form to change the tax system to, it's no different than on my infamous Tax Legislation-Digestion poster. Tax simplification proposals start off very appetizing and appealing, like an apple pie. However, after making their way though the legislative process, the end results are much the same as an apple pie after making its way through the body's digestive system. It has been re-formed; but is it better? Our tax system is an irreparable monstrosity that needs to be ended, not mended.

KMK

Saturday, November 23, 2002

Not Keeping Up With Real Life

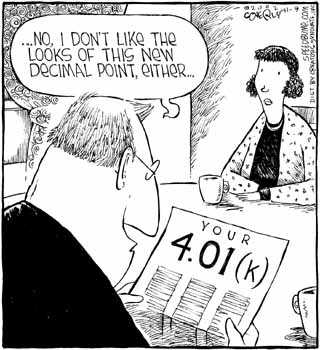

There are several special dates and amounts in the Infernal Revenue Code that were established decades ago and have never been updated for current times. One of them is the age at which people are supposed to start drawing out their tax deferred retirement money and paying normal income taxes on it. Our rulers didn't like the idea of people holding on to all of their retirement savings and passing away before they can get their hands on a chunk of it. A rule was enacted requiring that people start withdrawing the money by April 1 of the year after they reach 70.5 years old. The minimum amount of money to be taken out each year is based on an actuarial life expectancy, with the goal being that the last penny is removed as you take your very last breath.

The special age of 70.5 was also based on the assumption that most people would stop working at the normal retirement age of 60 or 65. Socking away a lot of income into retirement plans during high tax bracket earning years, and then withdrawing it in low tax bracket retirement years, has long been a very effective tax planning strategy. However, as this article describes, fewer and fewer people are retiring at the magic age of 65 any longer. While not everyone is still earning a paycheck at 98 (as the woman in the article) or 100 (as with Senator Strom Thurmond), many are still employed well past the 70.5 year mark.

In a rare attempt to bring the tax code more into synch with real life, some of our rulers are trying to pass a law allowing a later start date for the mandatory withdrawals from retirement accounts, or even removing the requirement completely. Afraid of the possibility of less tax money, the DemonRats are working hard to defeat this measure.

I hope every senior citizen understands that, contrary to normal propaganda, the JackAss Party is not their savior. I constantly have to remind people that it was the Clinton-Gore team who drastically raised taxes on Social Security recipients in 1993. With life expectancy continuing to increase, why can't people decide for themselves when to start drawing out their retirement funds?

KMK

LP vs GOP

It has long been a dilemma for those of us who strongly believe in the Constitution; whether to stick it out with one of the big political parties (neither of which fully supports the Constitution), or go with a smaller party that does, even though it is often a hopeless cause. When there are issues on which we can agree, we Libertarians have no problem working alongside the big parties to accomplish the goals.

Overall, it has long been the Republicans who have been more closely in synch with us. Some Libertarians have even run for office as Republicans in order to have a better chance of being able to get into position to have more actual political power than just yelling from the sidelines, as most of us have to do. Former Libertarian Presidential candidate, now Congressman, Ron Paul of Texas, is a good example of this.

Maybe it's my imagination; but since the recent election, I have been noticing more discussions of how Libertarians and Republicans can or cannot work together. Here is a Libertarian who voted for Bush, expressing his current disappointment in the GOP; while here is a piece on how the GOP should try more to work with Libertarians. I'm willing to work with anyone of any party who has a plan to restore the Constitution, reduce the tax burden and the size of government.

KMK

Thursday, November 21, 2002

Good Riddance

I guess there won't be a lot of people sorry to see the current IRS Commissioner pack it in. We shouldn't hold our breath waiting for him to be held accountable for allowing the Clinton Gang to use the IRS as a personal hit squad against critics.

KMK

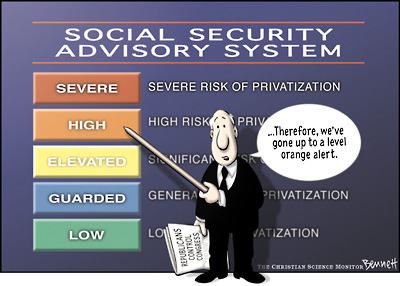

Old Play Book Failed

Like with a football team that uses the same plays over and over, year after year, their effectiveness eventually wears off. The JackAss Party is so bereft of ideas and talent that they have been relying on the same old scare tactics and even resurrecting nearly dead candidates.

Fortunately, the public has wised up and realized what a load of donkey meadow muffins the campaign rhetoric is. We have made some progress by finally being able to put to bed the now-failed claim by the Dems and their media propagandists that the GOP wants to destroy the Social Security system and murder all senior citizens.

KMK

Tax Reform

I hope Bruce Bartlett isn't holding his breath waiting for the Dems to take his advice and work towards the kinds of tax reform that we really need in this country. Of course, the term re-form really just means change, not necessarily for the better. The Dems would love to change our tax code back to how it was before the Reagan tax cuts, with a top marginal individual tax rate of 70%. Money is power; and the more of our money our rulers take, the more control they can exert over us.

As someone who has been working within the tax system for almost 27 years, I have long realized that it is far beyond repair and needs to be completely junked. End it, don't mend it. As advocated in this article by Ilana Mercer, the only realistic way for the American people to be safe from the tyranny of our rulers and their Gestapo hit-men, the IRS, is to repeal the 16th Amendment. Anything less is no better than just rearranging the deck chairs on the Titanic.

KMK

Tuesday, November 19, 2002

Internet Sales Taxes

The quest continues for a simple manageable way for states to tax purchases made over the web by their residents from out of state vendors. Given the literally thousands of state and local jurisdictions that each have their own sales taxes, I'm not very optimistic about them ever agreeing on what anyone could classify as a simple system. Just look at how well the Feds have done in simplifying the income tax system; and that's just for one jurisdiction.

KMK

Charitable Accounting Tricks

It's not just the big evil corporations that have been using creative accounting techniques to paint a different picture of their finances. One way that charities are evaluated is by the percentages of their revenues that are spent on fundraising activities, administration, and providing the actual services they were established for.

With big middleman charities, such as United Way, under continuous scrutiny for their million dollar salaries and other very lucrative perks for top executives, it shouldn't surprise anyone that they would be playing games with their numbers. By using accounting tricks to inflate revenues and reduce certain expenses, they are able to shrink the perceived percentage of revenue used for administrative, as described in this NY Times article.

As I have said for decades, your charitable donations are much more effective when given directly to the organizations you support that provide actual charitable services. Giving to middlemen means that a good chunk of your money will never benefit any actual charitable cause; but will instead feather the nests of executives of the middleman organization.

KMK

Monday, November 18, 2002

Having the same name as a presidential wannabe, I'm sure this won't be the last of these that I am tempted to post.

Sunday, November 17, 2002

Taxing the Big Apple

I'm not the only one who thinks NYC Mayor Michael Bloomberg is a huge hypocrite by having run as an anti-tax capitalist and then pushing for huge tax increases when in office. As I've said before, hiking property taxes by as much as Bloomberg wants will have a seriously negative effect on real estate values.

His other nickname, Nurse Bloomberg, for trying to ban all smoking inside his city, proves that he is the classic definition of a RINO (Republican In Name Only). He seems more suited to being a politician on the Left Coast, where the rulers try to micro-manage every detail of everyone's life

KMK

Friday, November 15, 2002

Continuing Debate

As the GOP takes over the Congress, there will be a lot of discussion over making the current tax cuts permanent. The foes of this will trot out their standard arguments that a tax cut hurts the economy and creates budget deficits. This static analysis of tax law changes, which I have discussed on several occasions, is just a theory and has in fact been debunked by the real life experience after the Reagan tax cuts of the 1980s. That proved that a dynamic look at the ripple effects of tax cuts is the only realistic way to analyze this kind of thing. We will be seeing an endless number of articles such as this, discussing this very point.

In a similar vein, this article has Alan Greenspan acknowledging that the current deficit would be much larger if there hadn't been a tax cut. This is in total contrast with the liberals' idiotic claim that the tax cuts caused the deficit.

KMK

A Law Abiding IRS Commissioner?

As this commentary discusses, it would be a novel approach to have an IRS Commissioner who was more concerned with the taxpayers' rights than in just squeezing more money out of everyone. We also shouldn't overlook the fact that the retiring commissioner, Charles O. Rossotti, assisted the Clinton Gang in using the awesome powers of the IRS to attack their critics.

KMK

Wednesday, November 13, 2002

Poor IRS

So, who do you picture hosting the telethon for IRS to give them all of the money their fans think they deserve? How about Willie Nelson?

KMK

GOP Revises Agenda Of Extensive Tax Cuts

Leaders Pursue More Modest Proposals

as the wimp-out begins

KMK

Lott says he wants to make Bush's tax cuts permanent

Let's hope he doesn't wimp out, as he usually does in any confrontation with the Dems.

KMK

Tuesday, November 12, 2002

Sunday, November 10, 2002

Two Californias

During the entire 38 years I lived in the PRC, I was among those who thought we should have divided the state into two separate ones. We Northern Californians had nothing in common with those who lived down South in LA-LA land. Whenever we had droughts up North and were not allowed to wash our cars or water our lawns, we were treated to photos of the Southern Californians doing just those things with the water that they stole from our Delta area and diverted down to themselves.

While the natural division of the two Californias always seemed to be by bisecting it cross-wise in the middle, this map and analysis of the voting last week for governor shows that a more politically feasible division would be to section off the liberal coastal counties from the more conservative inland ones. It's very similar to the blue and red state map of the USA after the 2000 Bush vs Gore election. For some reason, liberals have a tendency to congregate more on the coasts, while the more conservative members of our society seem to be satisfied living in fly-over country.

KMK

Not Giving Up

It's good to know that the only political party that actually advocates removing taxes isn't giving up their efforts after just one loss at the ballot box. Here in Arkansas, the State party leaders are already preparing for a petition drive to put another measure on the ballot to remove sales tax from human food and medicine. In Massachusetts, they are going to take another stab at removing the state income tax.

We didn't arrive at such high levels of taxation overnight. It will take patience and persistence to change the momentum to the other direction.

I hope the New York Libertarians are doing what they can to prevent NYC Mayor Bloomberg from implementing his planned $2 Billion annual increase in property taxes. For someone who is supposed to be a Republican and a capitalist, the new mayor is acting like anything but.

While some may blame term limits for not allowing Rudy Giuliani to serve a third term, it's really his fault for not considering the need for a successor to carry on his fine work. I know Rudy is currently riding high on his recently published book, called Leadership, which I must admit I haven't read. While I have no criticism of his accomplishments as Mayor of the largest city in the nation, I'm sure even he would admit to being lax in the area of planning for leadership succession.

KMK

Pro-Business Agenda?

Those of us who believe in the principles of capitalism can only hope that there is a strong move in the direction of pro-business legislation in DC before the November 5th euphoria wears off. Unfortunately, moderation is still the main driving force among our rulers; so I don't expect to see as dramatic a shift in tone as the liberal media are warning about.

KMK

Saturday, November 09, 2002

Easy To See In Hindsight

It's easy now for most people to look back at the dot-com stock bubble and recognize it as what it was, a greater fool pyramid scheme. A lot of good this Monday morning quarterbacking does for those who relied on investment advisors who were too stupid to see through the phony market back when it counted.

Unfortunately, historical memory is so short in this country that few will recognize it when it happens again, which is the only way that people can be warned about it. As someone who received a ton of criticism during the dot-com bubble for taking a contrarian approach and refusing to buy into its bogus assumptions, I don't have much hope of things being very different next time around.

What never ceases to amaze me is how people who have been so incompetent in the past can even stay in business. For example, will toe-sucker Dick Morris' ineptitude in analyzing the just completed political campaigns hurt his lucrative TV and writing career? Not likely. Similarly, how can any financial advisor who promoted dot-com stocks even have any clients left? Anyone who is foolish enough to continue relying on advice from any financial professional who fell for the dot-com bubble will receive no sympathy from me when they lose even more of their money.

KMK

Scripted

If you've ever listened to a telemarketer's spiel, it's obvious that s/he is just reading from a script. Often times the callers are actually incarcerated prisoners (a commonly used labor force by companies that think telemarketing is a useful tool for their business) with a very limited command of the English language.

In the spirit of the Seinfeld episode where Jerry asked a caller for his phone number so he could be called back, a person in The Netherlands has come up with an amusing full script (in English) that can be used in response to those pesky calls. This might be more fun than just hanging up on them or asking them to hold for a minute and leaving the phone sitting for half an hour.

KMK

Cracking Down

IRS and the Justice Department have been busy nailing more tax protestors and promoters of these schemes and sending them to prison. One of the first ones mentioned in this article actually used to work for IRS and expected a jury to believe his story that he didn't know his own income was subject to taxation.

IRS needs to make sure that this news is disseminated as widely as possible. A good place to start would be on the websites for the protestors. A welcoming message something like "This site is currently unavailable while its owner serves his sentence in federal prison for tax evasion" would go a long way in informing curious people as to the consequences of following the leads of these charlatans.

KMK

Friday, November 08, 2002

On the Right Path

It's a bit premature to consider much needed tax law changes as reality. However, with the GOP finally in charge of all three main houses of power in DC, they will finally have the chance to show us what they can do.

Social Security Reform

Permanent Additional Tax Rate Cuts

Killing the Death Tax Forever

Our GOP rulers do need to act on these matters ASAP before their momentum slows down and the 2004 campaign gets into full swing. If Bush doesn't have a chance to sign them into law in the next two years, all hope will be lost because President Hillary Rodham definitely won't.

KMK

Hillary Style Investment Advice

I have to admit I'm not completely up to speed on all of the details for the plans to eliminate conflicts of interest in the stock markets and make investment advisors independent from their supporting underwriters. However, if this analogy of the plan currently under consideration being similar to what Queen Hillary tried to force on the nation's health care system in 1994 is true, I would agree that this issue needs to be seriously reevaluated. The entire idea of the financial markets being controlled in the same way Hillary wanted to control all medical care makes me sick to my stomach, literally.

KMK

The Wrong Path

I hope this story isn't true about growing popular acceptance in Tennessee for an income tax. While it is being sold with the idea of an offsetting reduction in the sales tax, that won't last long. It won't be long until the sales tax rates are back up. Of course, by then the income tax will have become a permanent fixture and removing it an impossibility. There is no such thing as a temporary tax. It is also true that any tax that starts off small will grow. Let's hope the people of TN can resist the siren call.

KMK

Scared Of Cash

I'm not a big believer in conspiracies. However, stories like this about how much more rampant counterfeiting is becoming do seem to play into the hands of the IRS. With more and more people afraid to use untraceable cash for fear of being stuck with bogus bills, they will have to use checks and credit cards, all of which leave auditable trails.

KMK

Stock Picking Formulas

I understand that some people consider this James Glassman guy to be some kind of financial guru. This article doesn't convince me much on that account. While he does have a decent amount of skepticism towards people who claim to be able to reverse engineer into magic stock picking formulas (the unachievable Holy Grail of finance), he makes one comment that betrays his ignorance of simple accounting.

He claims that comparing a corporation's stock price to its gross sales is a more practical approach to valuation than comparing it to the corporation's net profits because gross sales are harder to manipulate than is net income. What planet is this guy from? Artificially inflating sales figures is the easiest thing to do on this planet (Earth). Gross sales are routinely pumped up by artificial churning of sales in and out between allied companies. It's no more complicated than I sell a bunch of items to you and then you sell them back to me and so on and so on back and forth. The discovery of this kind of thing led to some of the big corporate accounting scandals of this past Summer. It is much more difficult (but definitely not impossible) to use churning to inflate net profits because someone has to eat the difference. Churning sales is a simple break even process.

One of the reasons I have avoided investing in the stock market is the fact that it is too irrational and cannot be defined by any kind of formula. Anyone who claims to be able to do that is nothing more than a con artist. The dot-com boom of the late 1990s proved that. Stocks were selling for huge multiples of their gross sales, while their bottom lines were projected to be negative for all foreseeable future time.

If you are going to objectively look at any stock purchase, you need to step back and look at it for what it is. As the new commercials for AmeriTrade (owner of Motorola in a tour bus, etc.) illustrate, when you buy capital stock, you are buying a percentage of the actual business. Try to extrapolate that concept to buying 100 percent of an actual business, such as a corner convenience store. When you and your financial advisors are deciding on a fair price to pay, which figure is more important: that it has gross sales of two million dollars a year or that after paying all operating expenses, the net profit is $10,000 per year? Would it be a wise move to buy the store for a million dollars? Anyone with even the most basic of accounting training would focus on the net profits. Part of analyzing any investments involves comparing alternative uses of the money. Why would anyone invest a million dollars to earn just $10,000 per year (a one percent yield) and also have to put up with the hassles of actually running the business when you could stick that money in a bank account and earn much more, with far less hassle?

How about paying a million dollars to buy a business that will lose money from now until forever, as dot-com stocks were? The only way that makes any sense is based on the greater fool theory, where you need to be sure a bigger idiot than yourself will come along to pay you more than you did. As with any pyramid or Ponzi scheme, greater fool plans eventually run out of fools and the market collapses.

KMK

Tax Cuts Do Stimulate Economic Growth

I have been sick for the past week, so I haven't been able to include as much of my own discussion of the topics as I would have liked. I was lucky enough to just post the articles that are worth being aware of. Not every article posted here is automatically something I agree with. It is important to stay aware of arguments used by the opposition.

Specifically, this piece from the Democrat Party's official publication, the New York Times, trying to make the case that there is no correlation between tax rate cuts and economic activity, is a perfect example of leftist distortion of the facts.

It conveniently glosses over the reason behind almost all of the economic growth in the 1980s and 1990s, the Reagan tax cuts. Dropping the top Federal marginal income tax rate from 70% down to 28% did more to encourage people to earn income than anything else I can recall in my lifetime. Anyone who claims otherwise is practicing the exact same kind of dishonest historical revisionism as those who state that the Reagan tax cuts caused the massive Federal deficits. Once again, the Reagan cuts resulted in more than double the overall tax revenues. The deficit was caused completely by Congress tripling the level of spending. The fact that Congress was controlled by the DemonRats back then is just a coincidence when the story of those times is reported by the media.

The other big lie repeated in the Times article is that the economy did very well after the humongous Clinton-Gore tax increases of 1993. Clinton worshippers have long claimed that his tax hikes were the reason for the booming economy of the late 1990s. I have long contended that Clinton was one very lucky SOB because the economy did well under his regime in spite of his tax increases, not because of them. Just as almost all State governments are learning, the driving force behind the 1990s' economy was the stock market, fueled primarily by the hyper-inflation in prices of dot-com stocks. That whole mess had nothing to do with the tax rates and was driven by a herd of greedy short-sighted idiots who pretended that money could be magically created out of nothing.

KMK

Thursday, November 07, 2002

Wednesday, November 06, 2002

Asking For Higher Taxes

As some columnists like to say, "Only in New York" would people ask for their taxes to be raised. Maybe that's why Queen Hillary has been so graciously accepted there.

KMK

Voting For Taxes

It was an interesting election around the country yesterday. What surprised me, as well as all of the pollsters, were the defeats of the two Libertarian sponsored ballot measures to remove taxes. In spite of predicted (feared) victories, both the repeal of the income tax in Massachusetts and the removal of the sales tax on human food and over the counter medicine here in Arkansas were severely defeated. It looks like the opponents of these tax reductions wasted a lot of time, energy and money in their efforts to keep them off of the ballot. Their scare tactics of how terrible things would be without those taxes did the job much more efficiently. I can't say I'm pleased with the results; but I am much more willing to accept them from the ballot than from a gang of elite rulers forbidding any say in the matter.

KMK

New URL

Due to serious reliability and support problems with the Blogspot systems, I decided to set up the new permanent location for this blog at www.TaxGuru.net in order to be separate from my main site. No future changes are expected. Please update your bookmarks.

This should actually work out better all around. Back several years ago, when the dot-com land-rush was hot and furious, I bought up several tax related URLs. Unfortunately, a CPA in the Silicon Valley beat me to the TaxGuru.com address; but I snapped up the dot-org, dot-net, dot-info and dot-us versions and have kept them on ice until the proper time.

While I already paid in advance for a year's hosting space on Blogspot.com, I just have to eat that. The Toronto hosting service we have been using for our other sites for several years, MyHosting.com, still has the best deal, with 50 megs of space for $9.95 per month. The transition to the new host went very smoothly. I am still using the Blogger Pro service to produce this blog.

KMK

Tuesday, November 05, 2002

Monday, November 04, 2002

LowDown On Scams

Here's a good recap of the most common types of scams that continue to capture gullible victims. It even includes some good slams at the tax protestor schemes that I have been warning about for decades.

KMK

Sunday, November 03, 2002

One Excuse

Maybe this is part of the reason for the terrible postal service we have here in the Ozarks. Arkansans are being used as pawns in a political game to hurt the reelection possibility of Tim Hutchinson.

KMK

Saturday, November 02, 2002

Friday, November 01, 2002

Stifling Democracy

Arkansas isn't the only state whose rulers have made it difficult for the little people to have any power in putting issues on the ballot for a popular vote. The rulers of several other states have placed similar hurdles in front of their subjects.

KMK

Food Tax Debate

Luckily, this will be all over next Tuesday. In the meantime, it's interesting to watch the fight. As I suspected, my opposition in yesterday's debate was just relying on standard talking points used by Chambers of Commerce throughout the State. She succeeded in getting their message across that this is part of a sinister Libertarian agenda to eliminate all government. It's not true of course; but she did her part in spreading that warning and scaring people about the evils of freedom.

One untruth that she said was that the side in favor of repealing the tax was better funded and spending more money on its case than the opposition. I knew that to be a lie because the only ads and literature I have seen are from the opposition. This article, with the most recent campaign disclosure figures, shows that the opposition has in fact raised twice as much in outside donations than our side has. What is not disclosed is the amount of taxpayer resources that are being used. The APPLES group opposing this measure consists mostly of government employees who are doing their lobbying and campaign work during working hours and using government resources. Those costs are not part of the official disclosure forms filed with the State.

Here is the report of yesterday's refusal by the Arkansas Supreme Court to grant the APPLES gang's request to toss this issue off of the ballot. The APPLES people have a twisted view of the electoral process in claiming that their constitutional rights have been violated by not being able to deprive the voters of the opportunity to vote on this matter. If they are as confident as they claim to be about the results going their way, why have they spent so much time and money trying to have this issue removed from the ballot? How does that make sense? I guess that is just another example of the oxymoron, Government Intelligence.

KMK

VAT's Interesting

More discussion of replacing the corporate income tax with a national sales tax. It has a long way to go before we would ever see such a radical change. It might be a step towards doing the same thing for individual income and estate taxes.

KMK