Tax Guru-Ker$tetter Letter

Friday, January 31, 2003

Speedy Net

I set my dad up with cable Internet service yesterday and am still in awe as to how fast it was. It was the easiest network setup and the fastest web surfing I have ever seen. Why anyone who has access to cable service would tolerate dial-up speeds is beyond me. I may sound like a shill for Cox, but what is even more amazing is the price. The cable modem only cost $75 and the service is $40 a month. I paid about $900 to have a satellite dish installed outside of my office a little over a year ago and I have been paying Earthlink $70 per month for service that is half the speed of my dad's. It is one of the few downsides to living in the boonies that we will never have cable or DSL service where we are. If we ever move, there will definitely have to be cable Internet service wherever we relocate to.

With the speed of cable or satellite, there is no more efficient browser for surfing the web than NetCaptor, which I have been hooked on for the past six months. It allows me to be on 75 to 100 websites simultaneously. Keeping up on the wide variety of news on the web is so much easier this way. When I shut down NetCaptor, it remembers the sites I had open and opens all of them the next time I start it up, making it easy to pick up right where I left off. It also has a built in popup blocker that is very efficient at preventing those pesky annoyances from reaching my screen.

KMK

Voters Deciding

Oregon voters said no to tax hikes. Wouldn't it be great if we could all vote on any tax increase rather then leave it up to our rulers to decide how much of our income we may keep?

There are far too many people who believe that what we earn is not ours to decide what to do with. Under their belief system (which sounds eerily like Karl Marx), all income and property belongs to the State and the little people may only keep what the elite leaders allow. How is the concept of all of the fruits of our labors and investments belonging to the State any different from slavery?

KMK

Wednesday, January 29, 2003

Financialphobia

How is it that they have an officially recognized disease in England for fear of finances? I always thought we here in the USA lead the world in stupid made up disorders. Who are the ambulance chasing lawyers going to sue on behalf of these sufferers?

KMK

Not A Slam Dunk

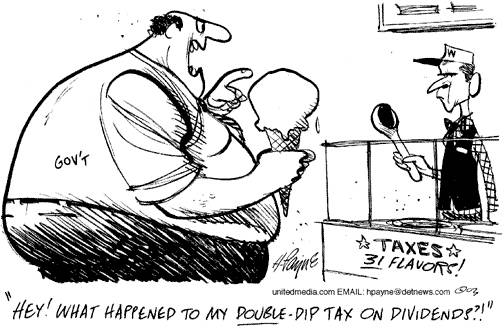

According to Bruce Bartlett, a change in the membership of Bush's economic advisory team may make it more difficult to keep up the push for eliminating the double taxes on corporate profits in the face of the left's class warfare. It will be a very tough sell to a country with almost no understanding of how a capitalist economy is supposed to function.

A caller to the Limbaugh show the other day was whining at how unfair it would be if his neighbor's dividend income were tax free while he had to pay taxes on his carpentry income. The caller was completely oblivious to the fact that such dividends represent income that has already been taxed at the corporate level and forcing the shareholder to pay a second tax would be the truly unfair thing. I have a hunch that such ignorance is more widespread than is healthy. So; don't start counting on tax free dividends just yet.

KMK

Section 179 Expensing Election

It seems like a lot of people were not aware of the ability to claim the very lucrative Section 179 expensing election for business vehicles weighing more than 6,000 pounds. It's only been the law since 1984; so it takes a while to filter out into the tax practitioner community.

I have had some people asking about going back and claiming it for past years. Unfortunately, that isn't possible. As with many tax return elections, they can only be made on original tax returns or on amended ones that are filed by the due date (including extensions) of the original return. That kind of thing is the reason that it has always been my policy to file tax returns late rather than rush something together that can't be changed, such as the Section 179 election. I still have several 1999, 2000 and 2001 tax returns in process.

KMK

Labels: 179

9-Digit 'Social' Overused as ID

It's good that they are finally realizing how dangerous it is to use SSNs for too many thing. However, for most people, it will be like putting toothpaste back in the tube in regard to getting control over their private SSNs. In spite of the claim on the SS card that it is "Not For Identification," it has become the de facto personal ID for almost everything. Filing Form SS-4 and obtaining a new IRS ID number may be the only way anyone can have any serious level of control over who has access to their personal ID.

Accelerated tax cuts receive support

As I said in 2001 when everyone was proclaiming this to be a huge tax cut, it's always a stupid idea to spread tax changes out over a long multi-year schedule. If reduced rates are a good idea ten years from now, they are an even better idea right now. A phased-in reduction is also always open to modification or freeze, as many of the DemonRats are still trying to do with the 2001 law.

Tuesday, January 28, 2003

New Treasury Secretary

I really don't know much about the new Treasury Secretary, John Snow. However, I do know Stephen Moore and respect his opinion; so it is encouraging to read his endorsement of Snow. It's also a good sign to see that Snow is behind Bush's tax cut plans. Former Secretary Paul O'Neill was openly opposed to tax reduction plans and thought it was more important to kiss up to Bono than help out overburdened US taxpayers.

KMK

The Greediest Generation

Although this is a little over a month old, it's a good argument in favor of Social Security privatization that I just came across. Doing nothing will just result in the inevitable implosion of the entire system

Monday, January 27, 2003

Just What We Need

The Bush plan is a growth engine that should be supported by anyone who believes in capitalism, fairness and private property, concepts foreign to most members of the JackAss party.

Record Retention

A common question I receive is how long we need to keep copies of our tax returns and the backup records. Copies of the actual tax returns should be kept forever. While most returns can't be audited by IRS more than three years after they were submitted, there are dozens of reasons why information from them is crucial to locate decades later, including after you have passed away. As I mentioned earlier, one of the most difficult tasks for anyone is taking care of a decedent's affairs. Not having access to copies of previously filed tax returns, often going back decades, makes the job even tougher.

As far as all of the backup documentation for your tax returns, such as cancelled checks, receipts and bank statements, those don't need to be retained as long. While there is no universal answer to this, I usually advise keeping everything for at last five years after a tax return has been filed. That takes you past the normal three year statute of limitations for IRS, as well as the longer four years used by some states, such as the PRC. Of course, if you have an unsettled matter, such as an open IRS audit for which the statute has been extended, you should continue to hold onto all substantiating documentation until the matter is completely over with, which can often drag on for a dozen years or so.

When discussing the matter of backup receipts, you need to keep straight which are period expenses, such as phone bills and mortgage interest statements, and which are capital asset purchases. Since most assets don't trigger any tax consequences until they are sold, you need to hold onto the purchase info until at least five years after you have reported their sale on your tax return. This is important for purchases of stocks and real estate. Unless you are claiming depreciation on it, IRS won't have any reason to ask for proof of an asset's cost basis until after you have sold it.

In these times of fast changing technology, besides what you hold onto, it's important to keep tabs on how your records are maintained. As this article points out, if your crucial documents were created by certain software programs, you may be out of luck in a few years if you no longer have access to that program or one that can read those kinds of files. Similarly, the physical medium used is important. I still have a stash of the old real floppy 5.25" disks with some clients' data. None of my current computers has a drive that can read those disks; so I'm hoping I don't have a need for any of that data. If so, I do have some floppy disk drive that I can salvage from the dozens of old computers in our PC graveyard upstairs. Since many newer computers are being produced without any floppy drives, even the 3.25" disks may not be readable in the near future. Copying their data to a CD would be a good idea for long term storage. With DVDs close to killing the market for VHS, getting valuable data off of video tape cassettes and onto video CDs is a project we are going to be starting on soon.

KMK

Choosing Their Battles

The only war the DemonRats want to fight is pitting groups of Americans against each other via class envy. Luckily, it doesn't seem to be as effective as it has in the past. To be more accurate, Dashole's helmet should have a hammer and sickle emblem.

Sunday, January 26, 2003

Remember the Cause

I have always received a lot of flack over discussing political issues in the context of taxes. Most other tax speakers and writers assume that taxes just happen in a vacuum and refrain from making any connection between what goes on in DC and our 1040 forms. That is just insanely naive.

I have always known that taxes and all of the messy laws, rules and regulations are merely symptoms of the real problem, which is the growth of government well beyond its intended scope of responsibility as envisioned by our founding fathers. While most people continue to clammer for new government programs with the assumption that the money for them will just magically appear, I know better. Every single program is paid for from money out of our pockets. It's really no different than if your next door neighbor came over, stuck a gun in your face, and demanded that you pay for his medicines or his kid's college tuition. Of course, our rulers have the IRS to do that dirty job for them. The end result is no different.

If only more of our rulers in DC would openly address the issue of the need to scale back the size and cost of government, as Georgia's Senator Zell Miller does here. Amazingly, he's a member of the JackAss Party, whose official platform believes that there is no part of our lives that the Federal government shouldn't control.

KMK

Let's hope he doesn't give up the fight for lower taxes and wimp out under pressure from the class warriors, as he has already done with other conservative issues.

Accountants, Lawyers Clash Over Tax Work

This is nothing new. There have always been disagreements as to where the line is between accounting and legal functions. I can remember discussing the issue of when accounting and tax services come close to practicing law in my accounting classes in college in the mid 1970s. Every profession wants to protect its monopoly power over its turf.

KMK

Saturday, January 25, 2003

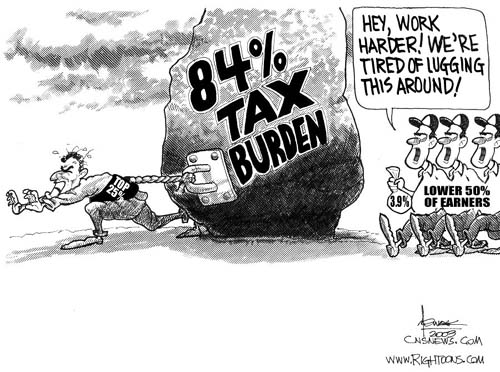

Although there is a big discrepancy in who pays the major share of taxes in this country, the widespread confusion over the horrendous tax code is shared by everyone of all income levels.

Senate Democrats Introduce Payroll Tax Refund Plan

I would actually support this idea in addition to Bush's cuts, not instead of. For many people, payroll taxes are much higher than their income taxes. In addition, this would be a nice tax cut for employers.

KMK

Social Security Reform

Allowing people to have more control over where their retirement money is invested is another issue that still needs to be addressed. Although in the long term, investing retirement money in the stock market is not as risky as it would seem from the past few years' performance, I am no more a fan of investing retirement money in the stock market than non-retirement money. There are plenty of other much safer investment vehicles that will be more certain to provide for future years. However, given a choice between the Federal Social Security Ponzi scheme and other alternatives, I would have more confidence in lottery tickets than in entrusting any more money to our incompetent corrupt rulers in DC.

KMK

Another Questionable Poll

I have always been skeptical about public opinion polls for several reasons. The fact that the pollsters slant their questions in such a way as to achieve desired results is a big reason not to trust the conclusions. This poll that claims that a majority of people don't believe that taxes are too high in this country has its own built-in idiocy. One indicator that the respondents weren't exactly Mensa material is the explanation that, because they had too much tax withheld from their paychecks and thus received refunds, their taxes aren't high.

KMK

Estate Tax Is Still An Issue

With all of the current focus on proposed changes to the income tax laws, such as making corporate dividends tax free, we need to remember that the issue of repealing the estate (aka death or inheritance) tax is still too important to overlook. The threshold for taxable estates will be getting higher each year until the tax doesn't apply to anyone passing away in 2010. However, the tax will pop back to life in 2011, with a taxable threshold of one million dollars, the same as it is right now.

There are still plenty of people, such as Bill Gates, Sr, who support the concept of having the government redistribute all wealth when people pass on. Whether this endorsement of a plank in the Communist Manifesto means Mr. Gates is a full fledged commie, I don't know. I do know that such confiscation of personal wealth is wrong. I haven't heard Bill Gates, Jr. state his opinion on his father's leftist views; but I doubt he is too worried. He has already protected his wealth through a series of trusts and foundations in the same manner as the Kennedy Klan did to preserve Joseph Kennedy's bootlegging and stock scam fortune for his descendents. Such tactics have enabled Teddy Kennedy to safely espouse confiscatory taxes on everybody else.

KMK

Friday, January 24, 2003

Poor On Purpose

It is true that there has long been a specialty in the financial arena called impoverishment planning. I must admit that I've done my share in helping clients arrange things so that they could qualify for certain government programs, such as Medicaid. I can't agree with the sentiment of this writer that this kind of thing is an evil scam to rip off the taxpayers.

All most people want is to be treated no worse than illegal immigrants. Is it fair that millions of people from other countries are allowed to sneak into the United States and then receive absolutely free medical care and education for their entire families for the rest of their lives, while people who have lived, worked and paid taxes in this country for 60 or 70 years are not eligible for the same assistance because they happen to own a home or a car?

KMK

Marriage Penalty

Don't shoot the messenger. Whenever I point out some of the penalties built into our tax system for married couples, I receive a lot of hate mail claiming that I am encouraging people to get divorced just to save on their taxes. That's not true. I merely point out the facts and let each couple decide for themselves how much extra they are willing to pay for the privilege of being married.

Here are some more of the tax breaks for unmarried couples. If you agree with me that it is insane to penalize people for being married, let your elected rulers know and don't accept that "we can't afford to fix it" crap from them as an excuse. If they can afford to give themselves raises and take all of their friends on expensive junkets around the world, they can surely afford to let married people pay the same taxes as single folks.

There is a misconception that the current Bush tax proposals will eliminate the marriage penalty. Not even close. It will allow a small deduction for married couples who both have employment income, similar to the miniscule one we had for a few years. It does very little to balance things out. The only true elimination of the marriage penalty would be to allow people to have their taxes computed in the same way as single people.

KMK

Thursday, January 23, 2003

This has always been the case with computers, which is why you shouldn't buy one that won't be put to use immediately.

More Complication?

As should be very apparent, I have always supported the concept of eliminating double taxation of corporate income by making dividends paid either deductible by the corporation or tax free to the recipients. Bush's tax cut proposal to make dividends tax free sounded easy enough at first. That's why I was disappointed to see this story about possible changes to the plan. Rather than take the simple straight forward approach of just making all dividends across the board tax free to shareholders, they seem intent on adding even more complexity to the tax system for both the corporations and the stockholders by making some kinds of dividends tax free and some still taxable. What a mess this will be for everyone.

Of course, as I have observed for decades, this is just business as usual for our rulers in DC. Never make a one sentence law when a 50 page version will allow more tinkering with people's lives. You would think that our rulers in DC are doing nothing but thinking up new ways to keep accountants busy with their never ending complicated tax law changes.

KMK

Wednesday, January 22, 2003

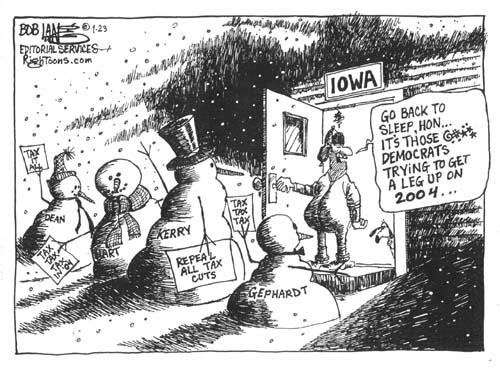

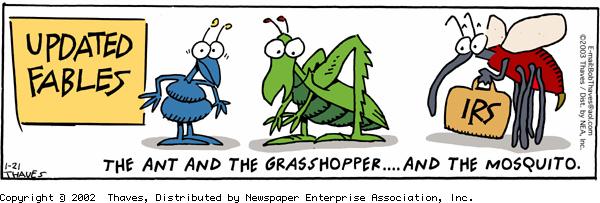

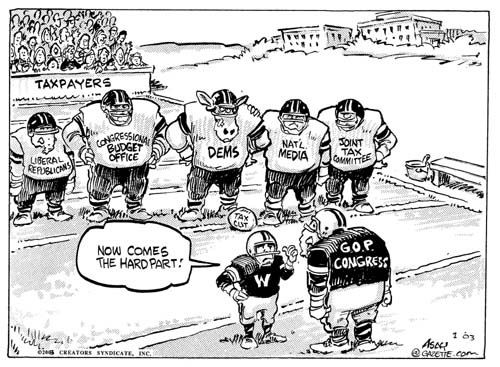

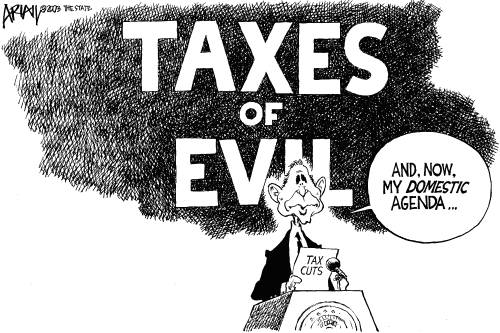

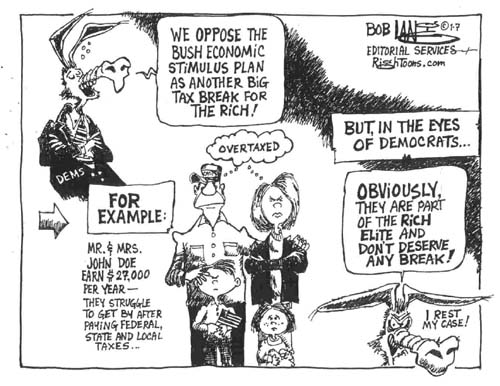

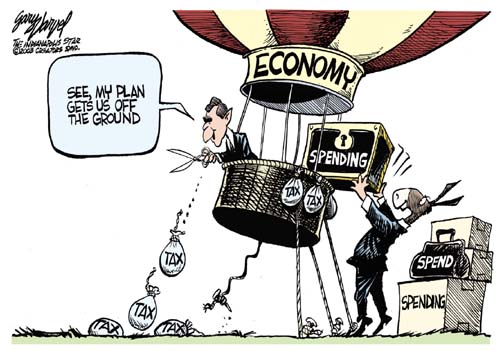

I'm not sure of the artist's intent with this comic; but I think it is to ridicule Bush. The truth is that anyone who understands capitalism and the US Constitution knows that many of the taxes in this country are downright evil.

Tuesday, January 21, 2003

Non-Cash Donations

I just finished installing the 2003 Tax Tools program and was checking out the new features added this year. One I really like is a five page worksheet, along with estimated values, for documenting non-cash donations, such as clothes and furniture. It obviously has a lot more room than the one page version I posted on my site a little while ago. I've made a master in pdf and uploaded it to my site.

KMK

Bush Proposal May Cut Tax on SUVs for Business

I'm sure Arianna Huffington and her fellow traveler SUV haters are having a cow over this.

Taxing Statistics

With all of the discussion as to who bears the major portion of the actual income tax burden in the US, I found it interesting to consider another kind of tax related burden. These stats from Forbes relate to the burden in time and cost to comply with tax laws in regard to keeping proper records and preparing tax returns.

Self-employed persons with adjusted gross incomes topping $200,000 spend 62 hours a year working on taxes and $1,315 in tax preparation fees, compared with just 34 hours and $393 for similarly paid workers who labor for others, says a new study for the IRS by IBM Business Consulting. Total annual out-of-pocket costs to all taxpayers for tax compliance: $16 billion.

Sunday, January 19, 2003

Glossary Of Terms

As with all professions, we in the tax and accounting arena have our own jargon. I have also adopted several other abbreviations and acronyms in order to save time and space when writing and speaking. As a public service, I've set up a glossary of the most often used terms. I've also added a link to it in the blogroll to the left on this page. If there are other terms that should be included here, please let me know.

As more new acronyms are coined every day, I hope to see glossaries such as this on other web sites. Places like Lucianne.com have developed their own shorthand way of communicating and it slows the discussions down when newcomers are always asking for definitions of such terms as PIAPS (pig in a pant suit) after stories are posted about our next president, Queen Hillary Rodham.

KMK

20/20 Puff Piece

I watched the 20/20 piece on Lynn Meredith, the scamster tax protestor, and the only way to describe the show was superficial. While I have never been reticent about pointing out the left wing bias in most ABC News broadcasts, this was one story in which they took no side. However, when someone is advocating illegal things, it seems like responsible journalism would cry out for the 20/20 staff to make the case that this woman is a criminal. It seemed more like a Robin Leach episode of the Lives of the Rich and Famous as they showed Lynn Meredith's fleet of expensive cars and her recreated soda shop, complete with antique juke boxes. They didn't do much to show the down side to Meredith's criminal actions, other than have to wear an ankle bracelet as she walked along the beach. I can recall a time when the media made a point of illustrating the consequences of choosing a criminal path in life. Just mentioning that another tax protestor had died in prison wasn't as illustrative as showing some of the convicted tax cheats doing hard time working on a chain gang busting up rocks.

While it may sound like I am most upset with ABC for the way in which they told this story, that's not the case. The brain trust at the IRS has proved their incompetence once again by refusing to comment on the matter for the show. What imbeciles. As I have been explaining for decades, the tax protestor movement has grown as a direct result of IRS neglecting their responsibility to debunk the bogus claims being made, such as taxes being voluntary and money is not really income. In this country, silence means agreement. Whenever IRS refuses to comment on matters such as this, they are in effect endorsing the other side's case. They passed up another golden opportunity to clear up a lot of confusion in the minds of the American people as to the legality of the claims being made by Ms. Meredith and her fellow tax protestor scammers. IRS spokespersons could have very easily debunked every one of Meredith's arguments and followed up with real life stories of people who are in prison for following them.

It's long been very frustrating that I have to do the IRS's job for them in explaining how the tax protestor arguments are wrong and dangerous. In a way, it's almost as if IRS wants the tax protestor movement to grow because they sure aren't doing as much to stifle it as they could. Maybe it's part of some scheme to justify even more money and power when the number of flagrant tax violators grows much larger.

KMK

Saturday, January 18, 2003

Non-Cash Donations

For the first time, I have purchased the CD-ROM version of the QuickFinder reference books that I have been buying for the past 20 years. It looks pretty handy, with PDF versions of both the 1040 and business books, as well as several IRS publications and forms. There are also several worksheets; most of which I don't need because my tax software already automatically does them. One that should be quite useful, plus covers information that doesn't show up in QuickBooks, has to do with donating non-cash items, such as old clothes and furniture. It even has some suggested values. I've posted that worksheet here on my site.

KMK

Tax-cut pollsters are up to their old tricks.

In typical liberal fashion, pollsters decide what answers they want and then word the questions to achieve those results.

The Smell of Money

Giving a whole new meaning to the need to launder money, these marijuana growers were busted after their bank teller noticed that their cash deposits had a funny smell.

KMK

Friday, January 17, 2003

S Corporations

Lately, I have been receiving a lot of feedback from various people around the country who have read my article describing some of the big differences between C and S corporations, thanking me for pointing out things that other advisors have been ignorant of. One area of confusion still seems to be regarding exactly when a corporation becomes an S. Many people believe that the decision to be an S or a C is made at the time when the corporation is originally formed. That is not true. All corporations, when originally chartered by the State, are C corporations. Do nothing extra and it will remain a C corp.

However, to convert it to an S corporation, the shareholders must all sign and submit Form 2553 with the IRS to request that status. This can be done right away after the corp is originally chartered, or several years down the road. You need to be sure to watch the effective dates of the S election. Some States automatically accept the IRS's S election, while others require a separate form to be submitted to the State tax agency.

If a corp has been using a fiscal year that ends in a month other than December, it will have to change to a 12/31 fiscal year end if it changes to an S status. If the S status is later revoked, you will not be allowed to change from the 12/31 year end.

KMK

Tax Protestor On TV Tonight

I was just scanning what's on TV tonight and noticed that ABC's 20/20 show is doing a profile on one of those idiot tax protestor promoters who claims that taxes are all voluntary and who supposedly makes a fortune selling her garbage to gullible saps. I haven't seen the show yet; but will try to watch it and report on how accurate it is.

I hadn't heard of this Lynn Meredith before, but found this report of her arrest in April 2002 for tax fraud. She is supposedly connected to Bob Shulz's idiotic and illegal We the People group, which I have discussed on several occasions earlier.

KMK

Presidents since Washington have fought tax battles

And CPAs since then have been helping their clients work with the tax laws.

If you owe the IRS a bunch of money, one of the things you shouldn't do is appear on national TV showing off all of your expensive possessions. It's a shopping list for IRS Collection Agents. Of course, celebrities aren't exactly known as being the sharpest tools in the shed.

It's not just a Hummer, it's a tax break

The backlash against SUVs and their tax breaks is continuing to grow. Anyone who may be planning to take advantage of this may want to do so soon, before our rulers react to the hatred for SUVs and remove this deduction.

I've long described what I do as helping real people win the Tax Game. Maybe Tax War would be more appropriate, considering the class warfare rhetoric used by supporters of big expensive government.

Thursday, January 16, 2003

WAGs

I must have seen at least a dozen articles in today's papers from the PRC such as this one on how Governor Gray-Out Doofus has been exaggerating the size of the projected budget deficit in order to better justify the laundry list of new taxes he wants to implement. As I've been explaining for decades, all such projections are nothing more than wild ass guesses. Nobody has the right to claim a perfect crystal ball on this kind of financial projection. Anyone claiming more accuracy than the governor is just as guilty of blowing smoke up our rear ends.

On a similar note, does anyone else have a problem with this report of record spending by state governments, while most of them are expecting budget deficits?

KMK

SEC adopts broader definition of `expert'

There goes our (CPAs) monopoly to be the only ones qualified to be on corporate audit committees.

Taxes Influence Behavior

Imagine that. Smokers in New York aren't just obediently paying the huge taxes on their drug of choice, but are buying them from out of state and tax free Indian vendors. As the PRC looks to add over a dollar per pack in new taxes, how soon do you think it will be before editorials like this pop up in Left Coast papers?

KMK

Loose Lips

I have long advised people who are able to claim generous tax breaks to be happy about that fact and keep it to themselves. Brag about something too much and sooner or later those who don't qualify for it will scream loud enough to force our rulers to scale back on the breaks. Envy, jealousy and outright hatred for anyone getting any more tax breaks than you are pervasive in this country.

This is the very reason for the 1984 luxury car rules. Before 1984, business cars of any cost could be fully depreciated over three years. Because so many big-mouths bragged about this, the backlash from those who couldn't deduct their vehicle costs was too much for our rulers to ignore. They limited the amount of a vehicle's cost that could be depreciated over five years. After adjustments for inflation, that limit currently stands at $17,410. Any vehicle costing more than that is by definition a luxury vehicle.

To distinguish between normal passenger and utility vehicles, our rulers established a break point of 6,000 pounds gross vehicle weight. Any vehicle weighing more than that is not subject to the luxury car rules and can be fully depreciated over five years. In addition, it qualifies for the immediate expensing election under Section 179 of the Internal Revenue Code, currently $24,000 per year. While I have been discussing this tax break since it as first enacted in 1984, the rest of the public didn't become aware of it until very recently as part of the open attack on SUVs and their owners by such loud mouth Socialist hypocrites as Arianna Huffington. It doesn't surprise me one bit to see editorials such as this one from the Atlanta Urinal-Constipation calling for our rulers to eliminate this lucrative tax break for evil SUVs. How long will it be before we have a repeat of 1984?

KMK

Labels: 179

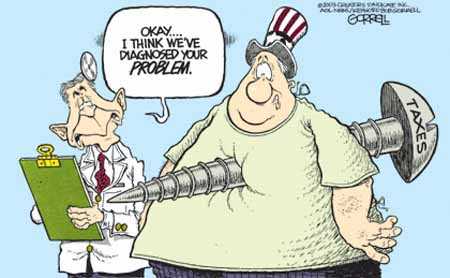

Put Government on a Diet

Another bull's-eye by Stephen Moore. I couldn't have said it better myself.

Job Security

As I've always said, and even illustrated, there is no more secure profession in this country than taxes. As this article points out, Bush's proposed tax law changes will make the tax code even more complex, providing much more work for us.

KMK

We Need Patience

I have been receiving a lot of e-mail asking whether or not Bush will be correcting some of the other long overdue problems with our tax system. While nobody wishes for sweeping reform of the tax system more than I do, I am also aware that we got to where we are in slow incremental steps, and drastic changes don't fly well with the American people. The hue and cry over the seemingly benign issue of removing the double taxation of corporate income shows what an uphill battle we have in undoing decades of growth in the scope, cost and complexity of the tax system.

I am just as disappointed as anyone that Bush isn't currently pushing as hard for such things as reduced capital gains taxes, removing the insane alternative minimum tax, removing the completely hypocritical limit on deductible capital losses, permanently repealing the estate tax, and really removing the marriage penalty (the provision in his plan only makes a minor token effort on this matter).

I have seen quotes from various GOP rulers who claim that the current tax reduction proposals are only the first step and more will follow. We can only hope that is true. If the JackAss Party remains as disorganized as they currently are, and the GOP can unify behind a tax reduction and fairness theme, we have a good chance of seeing the first positive signs of improvement in decades.

KMK

Free E-Filing

In its continuing move to encourage more taxpayers to file their tax returns electronically, IRS has announced that it will allow that to be done for free rather than require people to pay service providers or buy special software for this feature. I have no idea how many of the 78 million people who are supposedly eligible will take advantage of this free capability.

This is as good a time as any to refresh and update everyone on my opinions of electronic tax return filing. IRS is still strongly encouraging tax practitioners to file their clients' tax returns electronically in order to save IRS processing time. Tax software providers, including the ones I use (Lacerte and ATX), are increasing the e-filing features built into their programs. I am still refusing to partake of this for any of my clients.

Again, it has nothing to do with any fear of new technology. I have always been a very early adopter in the world of high tech. I refuse to have my clients electronically file their tax returns because doing so would increase the chances of their being selected for audits and causing other problems with IRS processing. The format required for electronically filing tax returns does not allow the detailed explanations and heavy documentation that I like to include with all of the tax returns that I prepare. I have been very good at anticipating those items on tax returns that could possibly raise IRS concerns. I then add plenty of additional info to the return to explain to IRS personnel why the numbers are as they are and why they are legitimate. IRS has always accepted those additional explanations and left my clients alone. With e-filing, I wouldn't be able to do that, putting my clients at additional risk of IRS hassles.

The question comes up as to whether or not I feel threatened by this IRS plan to allow taxpayers to bypass us professional tax preparers. Not one bit. This is no more of a threat to my business than the long time availability of do it yourself tax prep software, such as TurboTax. It is the classic garbage in, garbage out. The tax returns I work on require quite a bit of skill and knowledge as to where and how to enter information.

Tax preparer outfits that are no more than form fillers, with no intelligence or creative input required, will and should suffer from this new IRS feature. I don't own any stock in H & R Block, but my guess is that this ability for many of its clients to get the same service for free from IRS won't be a positive development for that company.

While I don't expect to actually use e-filing for my clients, I may have to sign up with IRS for an e-filing account in order to have access to some of the new web-based features that IRS is going to be unveiling soon. During the IRS webcast a few days ago, the IRS representatives described some improvements to their systems, including allowing us to access taxpayer accounts, obtain new ID numbers and trace payments over the Internet. However, to force those of us who refuse to participate in the e-filing program, the new features will only be available to those practitioners who are signed up as e-filers. I still have to see the details of this and whether it is an empty threat or not before signing up for an account.

KMK

Wednesday, January 15, 2003

Tuesday, January 14, 2003

Tax TV

I finally watched an episode of the IRS's Tax Talk Today webcast and was very impressed. This month's topic was the status of the 10 year IRS restructuring program. I wasn't too happy about some of their plans for the future; but I was glad to be alerted to them. While I watched it live this afternoon, they do archive the shows for later viewing. Viewing the shows is free for anyone. If you want one hour of CPE credit for it, you can fill out an evaluation and pay them $25. Since I have been happy with the approximately five dollar cost per CPE hour at The CPE Store, I passed on paying five times as much.

Next month's show, starting on February 11, should be interesting. It's on tax scams and schemes.

KMK

Californians duck sales tax by shopping across border in Oregon

What a shocker - not. People will always go out of their way to avoid paying too much in taxes; which is why we tax practitioners will still have plenty of work if the income tax is ever replaced with a national sales tax.

California's Economists Frequently Are Wrong

The Federal financial analysts are no better at predicting future revenues than the ones in the PRC, which is why any official forecasts of future numbers are no better than WAGs (wild ass guesses) and are not to be taken seriously.

Bush to Tap OMB Deputy as Head of IRS

I've never heard of this person; so we'll have to wait and see if he will be any better or worse for us taxpayers. One thing going for him is that he's not a Clinton henchman, as the previous commissioner was.

IRS Offers Foreign Credit Card Amnesty

IRS is giving people who have been trying to hide their income through foreign based credit cards a chance to come clean and avoid any of the criminal charges that this kind of scheme is liable for. These people have until this April 15 to voluntarily disclose their participation in this and avoid criminal charges. Just as with any past of our tax system, those who refuse to voluntarily comply will feel the full wrath of the IRS.

KMK

Monday, January 13, 2003

What is rich? In the world of the American taxpayer, you're only as upper-income as you feel

Why should I apologize for making lots of money?

O�Neill questions Bush�s tax plan

It's obvious that Bush made a very smart move when he kicked this bozo off of his team. A Treasury Secretary who doesn't understand the many widespread benefits of an elimination of the double taxation of corporate income was obviously in the wrong position. Hopefully he's enjoying his new life as a full time U2 groupie.

KMK

Sunday, January 12, 2003

Tax Burden

With the left's class warfare in full force, it's a good time for a refresher on how out of skew the tax burden is in this country. The liberals, in their infamous strategy of incrementalism, have done an excellent job of shifting the bulk of the tax payments to a minority of people, who are easily ganged up on.

A few months ago, Rush Limbaugh added a pie chart and links to detailed statistics on this point on the bottom of his main web page. He swears that it will stay there for the next 300 years to make sure this imbalance is not forgotten. Another good explanation of this persecution of the evil rich, with some handy charts and stats, is this article by William P. Kucewicz

Jonah Goldberg makes a good analogy of shared sacrifice between the taxes in this country and the military.

To top things off, there is no better example of how vulnerable we can become by relying on a small number of people to carry the load than what is happening in the PRC.

Proving that one person's blessing is another person's curse is this story about the uneven tax burden in Washington state. Having no state income tax, a larger share of revenues are generated by sales taxes. Since poorer people allegedly pay a higher percentage of their income in sales tax, the argument is that the state's reliance on that places a disproportionately high share of the overall tax responsibility on people in the lower income levels. This is obviously an attempt to start the ball rolling to establish a state income tax so that the super evil residents of that Left Coast state, such as Bill Gates, will be forced to shoulder a larger portion of the tax load.

KMK

Saturday, January 11, 2003

The hardest part about making the tax system fairer is weaning the big government vampires off of those dollars. Money for their insatiable thirst is far more important than any sense of fairness.

Friday, January 10, 2003

State hikes may offset Bush plan

As the president urges tax cuts to spur economy, states from California to Kentucky slash budgets and raise taxes.

Strangest state tax laws

Just wait until PRC Governor Gray-out Doofus comes up with his "solutions" to that state's budget problems. Strange will be the understatement of the year for those concoctions.

Don't Hate Me Because I'm Rich

The liberals don't just hate the super-wealthy, such as Bill Gates. As I've explained on several occasions, the definition of who exactly are the dreaded evil rich in this country differs for each tax rule. For example, single persons earning more than $25,000 per year and married couples earning over $32,000 per year are considered evil rich and are required to pay tax on 85% of their Social Security benefits in contrast to the original promise that all benefits would be completely tax free for everyone. Similarly, just as this article describes, a good many senior citizens receive dividend income.

Eliminating Taxes On Dividends

As was entirely expected, the lefties are playing the class envy card in their hysteria against the possibility of Bush proposing eliminating the double taxation on corporate dividends. "Tax cuts for the evil rich" is their mantra. Some recent examples of these anti-capitalism rants:

Washington Post Editorial

John M. Berry

Kenneth R. Bazinet

Assuming Bush can resist the desire to make his leftist critics like him, and dividend income becomes tax free to stockholders, it will change tax planning slightly. As I have explained for decades, using a C corporation allows you to reduce your taxes by tens of thousands of dollars each year. To avoid the double taxation, it has been my policy to never take out money from the corporation as dividends. We use expenses that are deductible by the corporation, such as wages, commissions, leases, interest and royalties. If dividends become tax free, these will be added to the equation and used when appropriate.

Shifting income to a C corp will still make a lot of sense. For example, if you are in the 35% bracket on your 1040, you can shift $50,000 to your C corp, where it is taxed at 15%. You will then be able to to have the corp pay you tax free dividends. That would save you $10,000 in Federal income tax alone ($50,000 X 20%). Since most business income would also be subject to the 15.3% Self Employment tax, by running $50,000 of profit through a C corp would save at least another $7,650 in that tax. The actual reduction in SE tax is normally much larger.

KMK

Computer Problems

We've all experienced computer bugs, both in software and hardware. In fact, 100% bug-free computers are a figment of our imagination. However, this is the first time I have heard of a computer snake. From the URL, it looks like this was in Australia.

KMK

Another Bogus Argument

The opponents of capitalism are grasping at straws in their propaganda campaign to rally opposition to the elimination of double taxation of corporate profits. The class warfare strategy has been exposed. Now, they are claiming that we can't make dividends tax free because it would be too difficult to keep track of that on corporate books and 1099 forms. That is absolute hogwash. Nothing could be easier in the world of corporate accounting. Of course, these same people on the left are the ones opposing any military actions because someone might get hurt. Their brains just aren't hooked up right.

KMK

As someone who is overly right-brained, with no artistic capability, I always appreciate finding examples where others can illustrate my points and save me the standard thousand words. It's especially good to locate comics that tell the right story. For every one I find that is truthful, there are at least a dozen by the left trying to portray tax cuts and Bush as evil.

I'm sure many people can relate to this situation.

Thursday, January 09, 2003

Bogus Numbers

As I've said on countless occasions, all official numbers describing the effects of changes in the tax law are 100% completely bogus. The numbers are fabricated by morons in DC who don't have a clue as to the real life effects of changes in tax laws. Then, to make the numbers sound even scarier, they use a multi-year bogus total, such as $600 billion over ten years. It's more inflammatory that way, rather than saying $60 billion per year. It would be just as accurate to rail against a $1,000,000 annual tax cut as a trillion dollars over the next million years. Either way, the numbers are absolute B.S. and anyone who cites them as valid is either a liar or an idiot and not to be trusted in the least.

KMK

Wednesday, January 08, 2003

Hatred Of the Rich

Jonah Goldberg and Ilana Mercer each have excellent pieces on how the left's intense hatred for the successful people in our country clouds their vision of what's good for the nation as a whole. They continue to be adamantly opposed to any kind of tax break for the wealthy, even if the overall benefits accrue to everyone, just out of pure vitriolic spite.

It's sick that our rulers would be so obsessed with this hatred, which is in a way a kind of self loathing since they themselves, with their huge salaries and lucrative perks and side incomes, are in the top income brackets. This attitude borders on mental illness. Keep that in mind when you listen to the sickos rail against Bush's tax cut for the rich, such as described here by William F. Buckley.

KMK

Loophole In Tax Code Means Big Tax Breaks For SUV Buyers

In typical incompetent fashion, this reporter implies that SUVs receive huge tax credits, making the cost to purchase almost zero. As I have been pointing out since this law was enacted in 1984, there is a very lucrative extra deduction for vehicles weighing over 6,000 pounds; but the actual taxes saved are based on your tax brackets. I have always advised against buying new vehicles just for their tax deductions. However, when already in the market for a new (to you) vehicle, the extra deductions for a heavier one may be the deciding point.

Since I last commented on this issue, I have received some questions as to whether or not the vehicle has to be brand new to qualify for the lucrative Section 179 expensing election. The vehicle only needs to be new to you to qualify for the Section 179, as long as you buy it from an unrelated party. This gives you the best of both worlds, if you buy a one or two year old truck or SUV. The bulk of the real world depreciation is gone and you can deduct up to $24,000 of the cost immediately.

If you buy it from a close relative or a corporation you own, IRS will treat that as churning and force you to continue the depreciation schedule that had been used by the previous owner.

KMK

Labels: 179

Deja vu. This is a perfect illustration of what happened with the Reagan tax rate cuts of the 1980s and why we had large deficits..

Tuesday, January 07, 2003

Dividend Hot Button

Of all the issues being discussed regarding Bush's tax proposals, the elimination of the double taxation of corporate profits seems to have generated the most discussion, both positive (from supporters of capitalism and fairness) and negative (from enemies of capitalism).

Dividend Comeback

Ending the Tax on Dividends: What, Why and How Much?

Stalked by Fears of Dividend Tax Cuts

The Dividend Tax is Double Trouble

Dividend Tax Relief Will Benefit All Americans

Bush�s Big Bang

Tax fairness fabrications

Eliminating double taxation of dividends is smart

Handy calculator to illustrate tax saved by eliminating double taxation of dividends

Don't Celebrate Prematurely

Bush's tax cut proposals sound very appealing and I will be monitoring and commenting on them in more detail as they work their way through the clutches of our rulers in the House and Senate. What will come out the other side will probably look and smell very different, so it's too soon to be making a lot of real life plans based on any assumption of the cuts getting through unscathed. While making the changes retroactive to January 1, 2003 is a good idea, the longer it takes before Bush can sign the actual law, the less likely they will allow the law to be retroactive.

KMK

Monday, January 06, 2003

Moving From Quicken To QuickBooks

In our push to get all of our clients using QuickBooks for all of their business and personal bookkeeping, we have had some resistance from people who are already using Quicken for their personal books. The only really good reason to stick with Quicken is if you are using its ability to check market values of your stock portfolio, a feature that QuickBooks doesn't have. If the benefits of that feature offset the more cumbersome file backup and sharing capabilities inherent in Quicken, and the clients are comfortable with the zipping needed to send me their data files, I've agreed to let them stay on Quicken.

An argument that I've received from a couple of different clients is that switching from Quicken to QuickBooks will cost them more money. While the QuickBooks program does have a slightly higher purchase price than Quicken, all of these clients who expressed that complaint were already using QuickBooks for their corporations' bookkeeping. My guess is that they were under the impression that they had to buy a new copy of QuickBooks for each company they were setting up books for. That is not true. With the same copy of QuickBooks (or Quicken), you can set up an unlimited number of different companies. I use my single copy of QuickBooks to work on literally hundreds of different company files. Normally, it's just a matter of setting up a company file for the 1040 info (Smith1040) and another one for the corporation's (Smith1120). Switching back and forth between them is very easy. I always add an "Open Company" button to the icon bar to make it a one click process.

Another possible reason for the worry over cost might be the perceived need to spend a lot of time reentering info into the new QuickBooks file that had already been input into Quicken. Again, this is an erroneous concern. QuickBooks is able to import every bit of information from a Quicken data file, with nothing lost in the transition. I have done it hundreds of times. The only limitation is that the version of QuickBooks you are using must be at least as new as the version of Quicken you had been using. For example, you can import Quicken 2002 data into QuickBooks 2002; but you can't import Quicken 2003 data into QuickBooks 2002. You would have to use QuickBooks 2003.

KMK

Sunday, January 05, 2003

Lessons In Incompetence

I don't intend to focus too much on the tax problems in the PRC; but since the rulers in Sacramento have dug themselves the biggest financial hole in the country, they are very illustrative for everyone. In fact, they have shown an almost perfect textbook example of how not to set up a state's finances. As these articles by Margaret Talev & Dale Kasler and Daniel Weintraub describe quite well, the PRC's tax revenues have been far too dependent on the fortunes of the wealthy people who haven't yet left the state.

As I have seen on several real life tax returns, this reliance on capital gains taxes has hurt Federal tax revenues as well. People showing huge gains on their 1999 tax returns have had huge losses on their 2000 and 2001 returns.

Of course, it would have been much worse for our rulers if the taxpayers hadn't been nailed by one of the most unfair double standards in the tax code. Capital gains are fully taxable with no maximum; yet capital losses are only deductible at a maximum of $3,000 per year per person or per couple. For some clients, who have carryover losses well over a million dollars from the stock market plunge of 2000 & 2001, I have my doubts whether they will live long enough to actually deduct all of their losses. Any unused losses expire when they do.

It's not likely that Governor Gray-out Doofus will solve the money problem with such brilliant ideas as taxing Internet sales or having volunteer organizations take on the work of the public employees. Of course, he really doesn't care if things are corrected because he has already been reelected to his second and final term in office.

KMK

Saturday, January 04, 2003

Killing the Tax On Dividends

Joel Mowbray is quite a bit more optimistic than I am regarding the prospect of an elimination of the double taxation on corporate profits. While he has a good point that totally eliminating the tax would be a statement of principle and just cutting 50% of the tax would be a cheap compromise, the latter is what almost always prevails in DC. There are too few in power who will stand up for the principles of capitalism and fairness. Sad to say, that goes for our MBA President as well, who is almost as wimpy as his father was in standing up to criticism from the high tax loving liberals.

KMK

Another Tax Protestor Down

According to this article on the IRS's bust of an illegal tax protestor promoter, there are 740,000 people in this country who are using bogus trusts and other illegal techniques to shirk their tax responsibility.

One way to look at this situation is that IRS is definitely going to have its hands full going after these flagrant violators. It's like when you're driving 60 in a 55 mph zone and there are four or five other cars doing 95 and swerving all over the road. Which cars do you think the cops will go after first?

KMK

Friday, January 03, 2003

Disservice Tax

As I constantly have to remind people, the issue usually isn't what the tax rate is; but what is subject to tax. That's why a flat income tax rate wouldn't really simplify things much. There would still be a lot of machinations in arriving at the taxable income figure.

In this same vein is the issue of sales taxes. Historically, most states only assess sales taxes on the sales and leases of tangible items and don't include payments for most services, such as legal and accounting fees. However, when a state becomes desperate for money, as is the case in the PRC, historical tradition can easily be tossed overboard. Since most politicians are very short sighted, they will be oblivious to the long term consequences of this quick fix.

KMK

President to Seek Dividend Tax Cut

This will only happen if Bush can resist the temptation to cave into the class envy rhetoric from the lefties who claim that this would be a break for only evil rich people.

Scandal Waiting To Happen

IRS is promoting its readiness for the upcoming filing season and advertising some improvements to its legendary customer service. A new upcoming feature of their website is the ability to log in and check the status of a refund. It's not functional yet, as can be seen on the page where it's supposed to be. While I have always been a big fan of self service functions on the web, such as tracking UPS and FedEx packages, I'm predicting that this won't be around very long before its lack of privacy controls leads to abuses, such as thefts from mailboxes. All you will need to enter on the IRS website is the name, Social Security number and amount to gain access to what should be confidential information.

As I've commented on many times before, the genie has long been out of the bottle in regard to the privacy of Social Security numbers. They are used on so many documents, that it isn't hard at all for people to have access to that and use it to check on upcoming refund checks. The only solution to this will probably be for IRS to assign taxpayers with a another new ID number that can be kept secret. Social Security numbers are anything but secret. Other security options may be scans of fingerprints or eyeballs, as in the movie Minority Report, in order to verify one's identity.

KMK

Outnumbered

As Bruce Bartlett mentions, it's a full time and seemingly futile job debunking the constant media lies about the US economy and how it works. He has the same pet peeve that I have, with the unending distortions of the facts related to the Reagan tax cuts and the deficit.

Normally, spreading the truth would be quite an uphill battle by people such as Mr. Bartlett and me. However, the monopoly on the news by the normal liberal outlets has been broken. It shouldn't be any surprise, as this study by the Pew Research Center indicates, that once people have been exposed to the wealth of information available on the Internet, they start to rely on it much more than the conventional print and broadcast outlets.

KMK

Wednesday, January 01, 2003

Salvation Army Decides Not To Accept $100,000 Donation

Interesting stand on principle by the SA against even legal gambling. I doubt if most other charities would be so picky as to the source of their donations. It reminds me of a story from about seven or eight years ago, when the Branson school district refused to accept a $50,000 donation from Wayne Newton because of his alleged connections to the Mafia.

KMK

State facing surplus of ideas to aid budget

Whatever they decide to do in the PRC, you can be sure it will become even more expensive to live and visit there. While most people would think that the residents of a state would be the primary targets of new taxes, most states and cities like to stick it to visitors through huge taxes on lodging, meals, rental cars, and airplane tickets. They are sitting ducks for extra taxes because they don't vote in the state they are visiting and can't get back at the rulers who levy those taxes on them. It's classic taxation without representation and there's nothing the visitors can do about it but not go to those places.

KMK

Fiscal Years

This isn't what I had in mind when I advised to set up C corporations on fiscal years ending in any other month except December. All the income shifting opportunities this allows are creative and aggressive; but 100% legal.

KMK

Credit Help Scam

I have heard on several occasions that the supposedly non-profit credit counseling organizations that advertise heavily are nothing more than fronts for the credit card companies. Their plan is to give debtors hope and prevent them from filing bankruptcy or negotiating settlements for less than full value. I don't watch CBS News, but found these interesting reports of their investigation into how some of these credit assistance clinics can make matters worse for people.

Part 1

Part 2

From what I have heard from clients and others with real life experience in this area, is that you are better off negotiating directly with the credit card companies to settle the accounts for anywhere from 40% to 60% of the outstanding balance in lieu of filing for bankruptcy. Some of the credit card companies are smart enough to realize that even 40% is much better than the zero percent they would get if the borrower does file for bankruptcy protection.

KMK

Hard To Believe

It's a bit difficult to take seriously this poll that has been receiving a lot of coverage in the news for the past two days. Supposedly two out of three people want the Feds to hold off on any more tax cuts.

My bet is that the wording of the actual questions was done in typical liberal fashion, such as "Should Bush give more tax cuts for Bill Gates and other evil rich people or use that money to fight the war in Iraq and feed unemployed poor people?"

Anyone can do a more realistic opinion survey by just asking everyone you meet if they would like their taxes reduced. If you find one out of ten saying No, contact Ripley's Believe It Or Not.

KMK