2008 AMT Exemptions

Q:

Subject: any update on AMT for 2008?

Just trying to get a handle on what my liability will be. Last year we crept over the line and we subject to AMT for the first time. I suspect we will be again this year, but would like to get a better fix on how big it will be.

thx

A:

As part of the big bail-out bill that was passed last month, the AMT exemption amounts were increased for 2008 to:

$46,200 for people filing as Single or Head of Household

$69,960 for Married Filing Joint or Qualifying Widow

$34,975 for Married Filing Separate

As it stands now, these amounts will drop for 2009 to:

$33,750 for people filing as Single or Head of Household

$45,000 for Married Filing Joint or Qualifying Widow

$22,500 for Married Filing Separate

Whether those figures will be changed is completely up in the air now that we have an anti-success Socialist administration ready to take over control of the tax code next year.

You can download the complete 24+ page pdf summary of the latest tax bill from The TaxBook at:

www.thetaxbook.com/updates/thetaxauthority_update_service/pdf/bulletin/10-10-2008_update.pdf

Good luck. I hope this helps.

Kerry Kerstetter

Labels: AMT

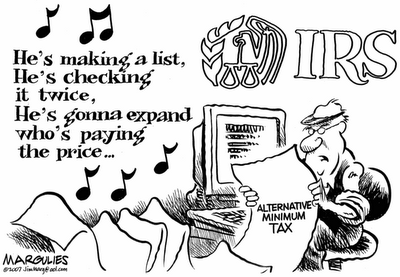

Updates from IRS on the upcoming filing season:

Filing Season Opens on Time Except for Certain Taxpayers Potentially Affected by AMT Patch

Alternative Minimum Tax (AMT) – How It Affects Filing Season 2008

Don’t Be Afraid of the AMT … Get Some Help – Another short guide to dealing with the Insane AMT.

The longer this mess drags on in DC, in terms of our rulers officially addressing this fiasco, the more obvious is their utter incompetence at dealing with common sense. While they may not agree with me that the entire AMT system should be jetisoned, how hard is it to understand the need to at least adjust the threshhold figures for inflation, as most other items in the tax code already are?

Labels: AMT

Taxing Time for Democrats? – A reminder by Michael Barone of what a messy tax planning environment we are looking at over the next few years. The increasing hit by the Insane AMT, as well as the upcoming expirations of the Bush tax cuts, are going to make realistic tax planning nearly impossible.

Again, this means more work for us in the tax minimization profession than we have ever seen before. Each change in the tax code will require more client consultations. Anyone who worries about being able to earn a good living in the tax business is crazy.

Labels: AMT

A Taxing Job – I have already started warning people that the confusion surrounding the Insane AMT is going to make this coming tax season quite messy, especially if a last minute patch is finally passed by our rulers. IRS tax forms have already been printed and we will have to make sure our tax software has been updated to supersede those forms that do it yourselfers will have to cope with.

Labels: AMT

Facing off with the Insane AMT

What the “Alternative Minimum Tax” Really Means for American Families – As if the regular tax code isn’t difficult enough to maneuver in, we now have to do more to work with the idiotic and Insane AMT rules. More costly neglect by our imperial rulers in DC.

Here is what the TaxCoach service has for an introduction on avoiding the AMT:

Alternative minimum tax (“AMT”) is a parallel tax designed to prevent “the rich” from using regular deductions to avoid tax entirely. In 2005, it hit 3 million taxpayers nationwide, primarily in states with high income and property taxes. (This includes IRS Commissioner Mark Everson, who announced in 2004 that he had been hit for the first time.1) But the tax is not indexed for inflation, and by 2010, it’s expected to hit 30 million, including 94% of married filers with children making $75,000 to $100,000.

The AMT system starts with regular taxable income then adds “preference items.” These include:

- Medical expenses between 7.5% and 10% of AGI

- State and local taxes deducted on Schedule A

- Home equity interest not used to buy, build, or improve your home

- Miscellaneous itemized deductions

- Investment interest figured according to special rules

- A portion of post-1986 accelerated depreciation

- Gains from incentive stock options (“ISOs”)

- Interest from most “private activity” municipal bonds

Once you’ve determined AMT income, subtract an exemption of $62,550 (joint filers), $42,500 (single filers), or $31,275 (separate filers) (2007). These exemptions phase out by 25 cents for every dollar of AMTI above $150,000 (joint filers), $112,500 (singles), or $75,000 (separate filers). The tax itself is 26% of AMTI up to $175,000 plus 28% of AMTI above $175,000.

Here are eight ways to help avoid the AMT:

- Don’t prepay state income and property taxes in years you’re subject to the AMT.

- Avoid private activity municipal bonds.

- Defer exercising ISOs where it makes investment sense.

- Capitalize, rather than deduct, investment expenses

- Schedule business equipment purchases when you can use your full depreciation deductions.

- If your employer reimburses business expenses, make sure you have an “accountable” plan to keep them off your return.

- Defer recognizing capital gains. These gains are taxed at the same 15% rate as for ordinary income; however, they increase taxable income subject to the AMT.

- Consider emancipating college-age children. The AMT disallows personal exemptions, so there’s no extra tax to pay by giving them up. Letting children claim those exemptions can save tax and qualify them for more generous financial aid.

If your regular tax is higher than the AMT rate, accelerate income into a year when you pay the AMT. You’ll save up to 9% if you can shift income that would otherwise be taxed at the top bracket into an AMT year.

Labels: AMT

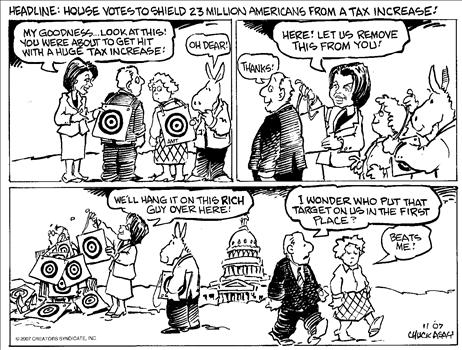

Democrats’ ATM, the AMT - A good piece by David Freddoso on how this coming tax season could be even messier than normal.

Labels: AMT

More attacks of the Insane AMT...

More Ill-Advised Tax Hikes - Fairness and common sense have to take a back seat to our rulers' addiction to the money this idiotic tax generates for them.

Rangel explains his NAMT

Rush Limbaugh and Paul Shanklin had this clip of Charlie Rangel in yesterday’s show explaining his new tax plan, to eliminate the current Alternative Minimum Tax (AMT) and replace it with the No Alternative Maximum Tax (NAMT). He explains that this means “You make it and we take it. No alternatives.”

Streaming audio from Rush’s site

Labels: AMT, comix, Commies, TaxHikes

Time for New Alternatives - More from the NRO editors on the need to repeal the insane AMT, but without the humongous tax hikes proposed by Charlie Rangel.

Labels: AMT

MAKING TAXES SIMPLER & FAIRER – Another reminder of the exponential growth of the insane AMT; from its original goal of sticking it to 155 super rich folks to the current situation of over 25 million victims.

Labels: AMT

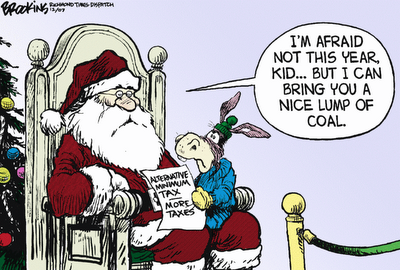

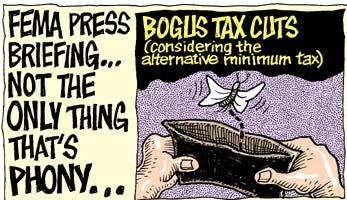

Attack of the Insane AMT...

(Click on image for full size)

It's no surprise that the DemonRats have more Marxist plans for dealing with the AMT problem.

Labels: AMT, comix, IRS, politics